The Bitcoin price is down 13% since the start of the year after failed attempts to end the bearish streak

As noted by trader Luke Martin, Bitcoin, the flagship cryptocurrency, has now spent the most days below the yearly open since the 2018 bear market as bulls struggle to regain momentum. ‘momentum.

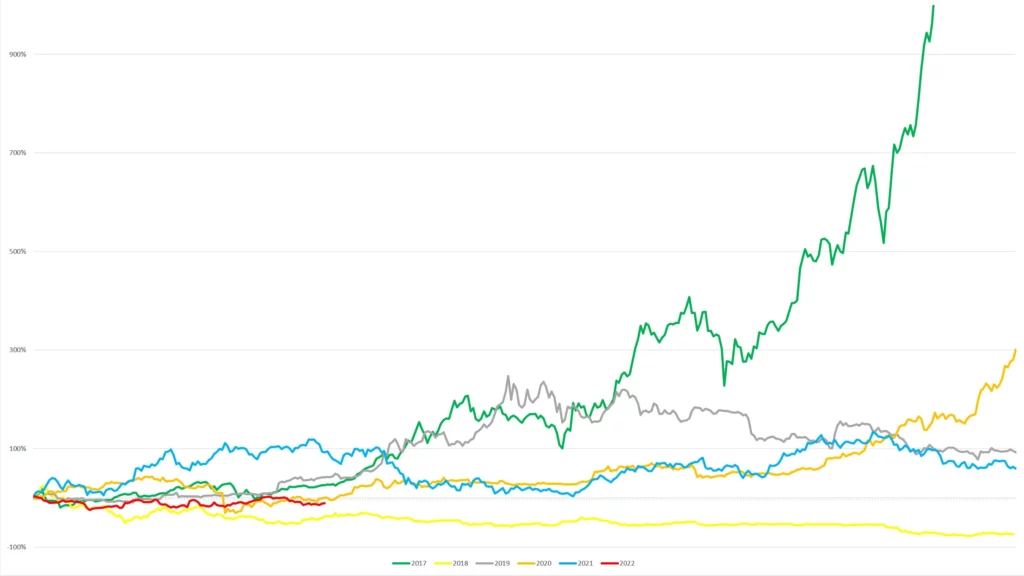

Notably, Bitcoin spent less than a month below the early open four out of five years over the period from 2017 to 2022.

The flagship cryptocurrency is currently trading at $41,384 on the Bitstamp exchange. It is down 13.30% since the start of the year, underperforming the S&P 500 index and gold.

As reported by U.Today, Bitcoin briefly turned positive for the year in late March and surged to a new 2022 peak of $48,189 on the Bitstamp exchange. The widely-tracked crypto “fear and greed index” also flashed greed for the first time in months due to improving market sentiment.

However, the recovery ended up being short-lived. On April 18, Bitcoin plunged to $38,536, the lowest level since mid-March. The escalating pace of interest rate hikes by the Federal Reserve is currently the primary concern for investors, as hawkish monetary policy is unlikely to bode well for risky assets such as Bitcoin.

The largest cryptocurrency is down a whopping 40.05% since hitting its current all-time peak of over $69,000. Yet, according to recent data provided by Glassode, roughly 75% of all Bitcoin addresses remain in profit despite the significant market correction. For comparison, only 50% were in profit in March 2020 after a massive pandemic-induced crash. Hence, it seems like the current bear market cycle is not as brutal as the previous ones.