In line with the lack of massive price movements from bitcoin, the number of Google searches for the asset have declined to the lowest levels since late 2020.

Separately, the popular Bitcoin Fear and Greed Index has settled into “fear” territory despite BTC’s two-day rally from the dip below $40,000.

Lack of Retail Interest

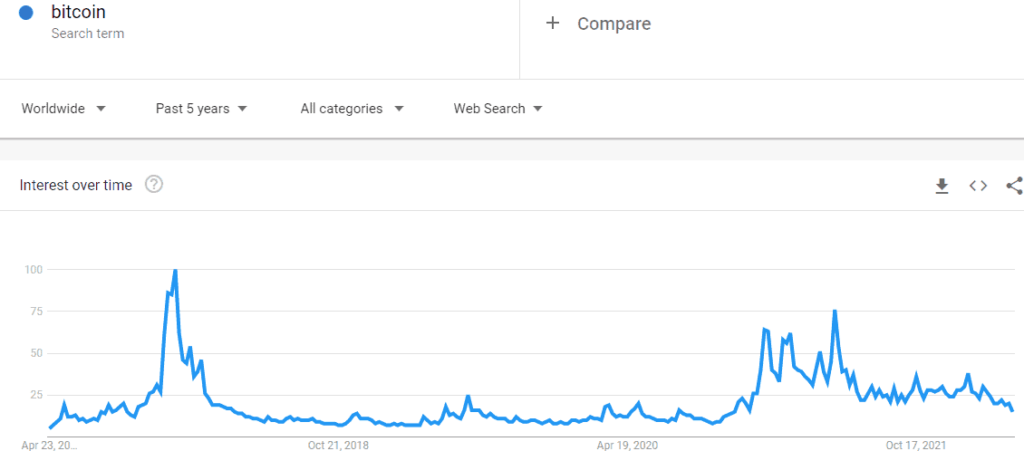

CryptoPotato reported yesterday the recent spike in whale activity towards the primary cryptocurrency. However, it seems that the demand from retail investors has declined in the past several months, at least according to data from Google Trends.

The number of queries on the world’s largest search engine generally shows the behavior of small investors, who tend to arrive on the scene in the midst of the most important bull runs. This was the case at the end of 2017 when BTC reached its then ATH at around $20,000.

As the asset went into a year-long bear market, the searches disappeared. Something similar transpired during last year’s price increases when BTC went on a tear in April and later in November, ultimately peaking at $69,000.

However, the cryptocurrency started to retrace again, dragging down almost 50% in about six months. Somewhat expectedly, Google Trends data now shows “Bitcoin” searches have fallen and declined to lows last seen in December 2020.

Fear Is Back Among Bitcoin Investors

The Bitcoin Fear and Greed Index estimates the general sentiment within the cryptocurrency community by examining various factors, such as price volatility, surveys, BTC dominance, trading volume, social media interactions, etc.

Its final results are displayed on a 0-100 basis, where zero represents “extreme fear” and 100 represents “extreme greed”.

Back in late March, when BTC was marching on towards the $50,000 mark, the metric went into extreme greed for the first time since November. However, as BTC started to cool off and even dumped below $40,000 in April, the Index went down to extreme fear (yesterday).

Today, it only shows fear, as bitcoin managed to recover Monday’s retracement and even touched the January 2021 ATH of $42,000.