Bitcoin‘s ongoing correction has had a repercussion on the entire cryptocurrency market. Ethereum, the largest altcoin suffered the same fate. At the time of writing, ETH suffered a fresh 4% correction as it slipped below the $3k mark- it traded at the $2,984 mark.

Slowly but surely

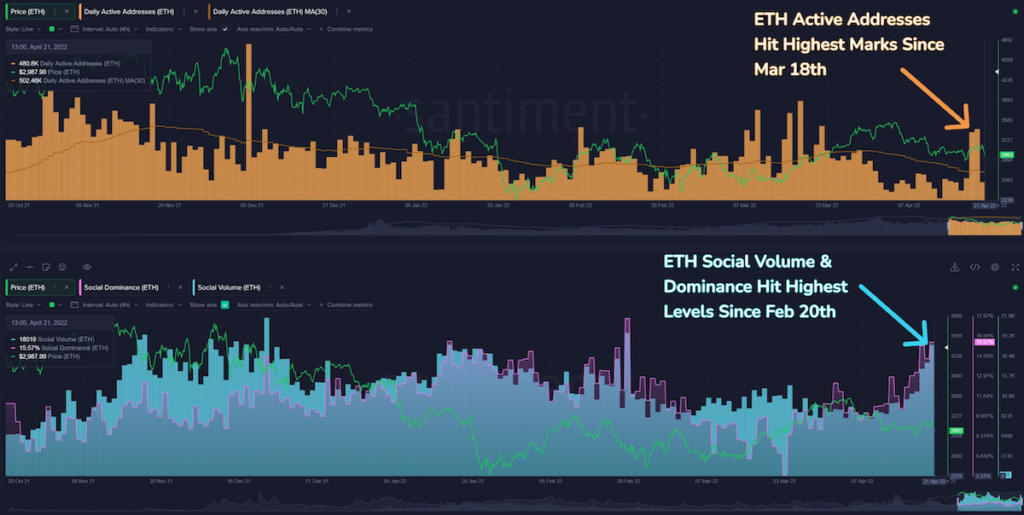

The largest altcoin, despite the given drawdown, has continued to maintain an impressive social streak. On-chain data provider Santiment reported one such case where ETH address activity ticked bullish numbers regardless of the aforementioned noise.

Considering the graph, Santiment noted:

“Ethereum’s address activity really picked up this week, with Wednesday’s 592k addresses being the highest number of unique interactions in over a month. Meanwhile, social discussion for $ETH has hit its highest levels in over two months.”

At the time of writing, the weighted sentiment measure hovered around the -0.9 mark. Contrary to popular opinion, prices tend to move against the expectations of the crowd. This could therefore inject positive sentiment, as prolonged negative weighted sentiment sometimes triggers a rally.

On a positive note

Considering this, ETH holders witnessed an incline considering the profit count as well. According to IntoTheBlock, 72% of ETH holders saw massive gains as compared to just 23% who faced losses.

All in all, the two aforementioned cases have shed light on a bullish scenario for the largest altcoin.

Supporting this insane run-up for the Ethereum price is the supply distribution chart, which shows that institutions and whales have been busy buying the dips. Likewise, as per a previous report, a spike in this metric indicated that investors accumulated in anticipation of an uptrend. Since early March, the wallets holding 10,000 to 100,000 ETH tokens increased their holdings from 24.85% to 25.62%.

Heavyweight investors like whales continue to remain positive about ETH’s price performance in the upcoming bull run.

That said, things could go south as well. Jack Dorsey, the Twitter co-founder raised some red flags for users. Dorsey, mainly laid out ‘many single points of failure’ thanks to ETH’s price volatility that can negatively affect the price action going forward.