Ethereum price shattered in the previous days after crossing the holy $3500 barrier in early April. In the past 36 hours, the ETH prices have fallen below $3000 after anticipations of the FOMC got through.

The crypto ecosystem had been concerned about the Federal President’s meeting on Thursday which did not end well. To stop inflation, the Fed has been under pressure to raise interest rates after resisting it throughout 2021.

On Thursday, Federal Reserve Chair Jerome Powell statement raised alarm bells across global markets. He said a half-point interest rate increase “will be on the table” in the next Federal reserve meet in May. With inflation running roughly three times the Fed’s 2% target, “it is appropriate to be moving a little more quickly,” Powell said in a discussion of the global economy at the meetings of the International Monetary Fund as Reuters reports.

What now for Ethereum?

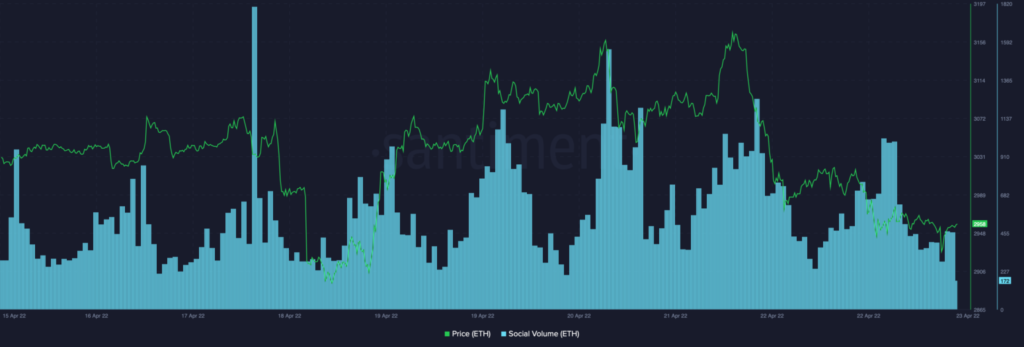

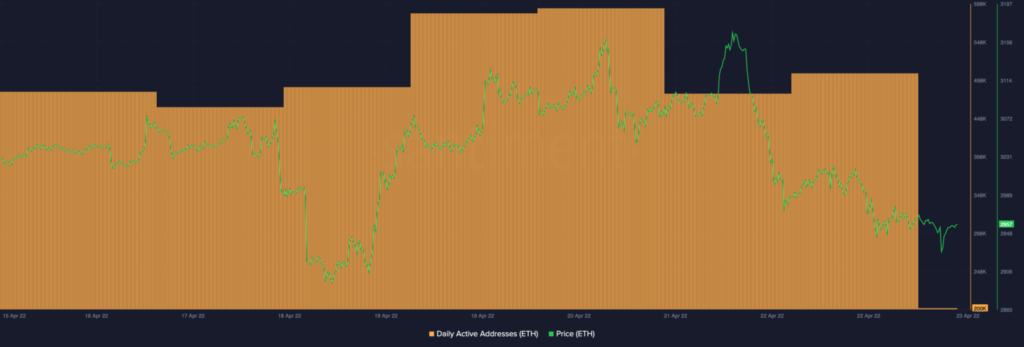

The Fed’s comments ultimately contributed to ETH’s slide. From the social volume graph above, it is clearly visible how there is a drop in interest in Ethereum on social media. However, daily active addresses have managed to hold their own despite the news from the Fed, which is not a good sign for the Ethereum community but isn’t too bad either.

Why? That’s because there has been no fall in users on the blockchain and it is a crucial time for the Ethereum community to build on that.

On a technical level, the Relative Strength Index value here indicates weakness on the charts with a value of 42.79 (at press time). This is still some distance from the oversold region, so a further correction from current levels can be seen.

This brings us to the question: should investors HODL or sell off while there is still time?

ETH investors eased on gas fees

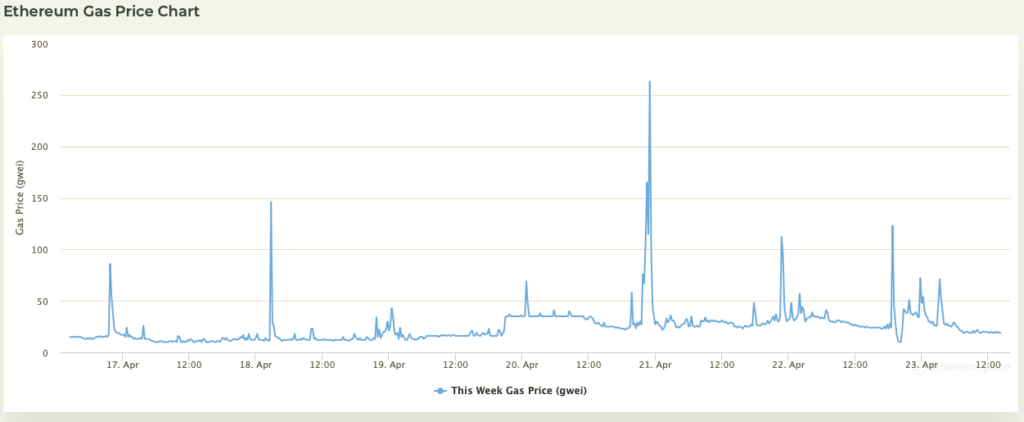

The rise of Ethereum gas has been a major concern for many blockchain projects. Being one of the most expensive, Ethereum has come under a lot of criticism. This has led users to turn to other more scalable and cheaper blockchains such as Polygon and Solana. Another new project called Bitgert is also on the rise as a potential competitor for Ethereum.

Realising the gas fee issues on the blockchain, Ethereum announced gas fee reductions in early April. This led to one of the largest gas fee reductions to be recorded on the blockchain. The average gas fees is currently on a 30 day low giving investors a reason to cheer in these uncertain times.