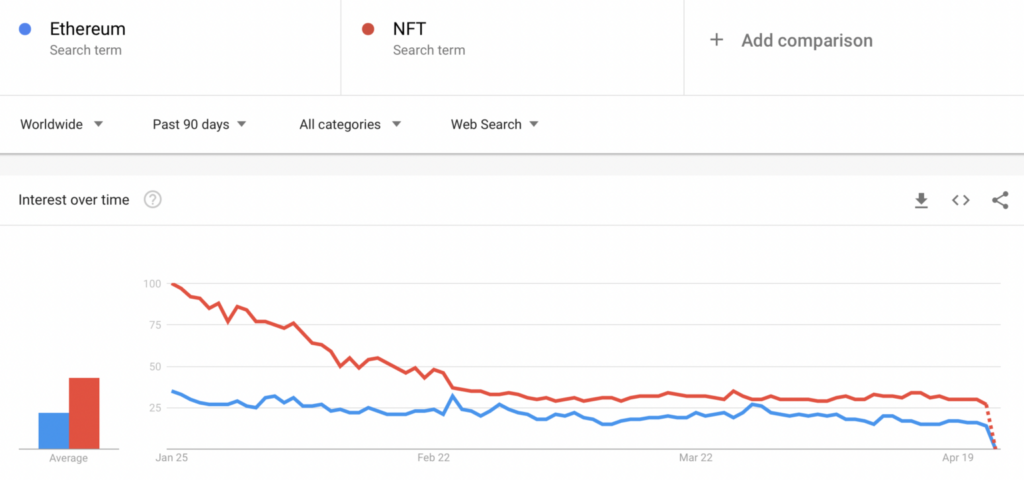

While not the most sophisticated of data tools, Google Trends is a way to roughly understand the level of interest that internet users worldwide have in a certain topic.

To that end, Google Trends data for the search terms “Ethereum” and “NFT” revealed an unequivocal end result. This is a decline in search interest since the start of the year.

Does this drop-off have any effect on price or market movements? Well, at press time, Ether [ETH] was trading hands at $2,854.57, after falling by 3.17% in a day and dipping by 2.14% in a week.

In contrast, when interest in Ethereum was higher, around January 25, ETH was only trading at around $2,400. For this reason, more searches may not mean higher prices or vice versa.

What about NFTs, however? According to CryptoSlam, NFT sales volume on Ethereum fell by 15.90% in the last 24 hours. However, sales were up by 53.25% in the last 30 days. So again, a fall in search interest is not strictly equal to a loss in price or volume.

Don’t “weigh” for me

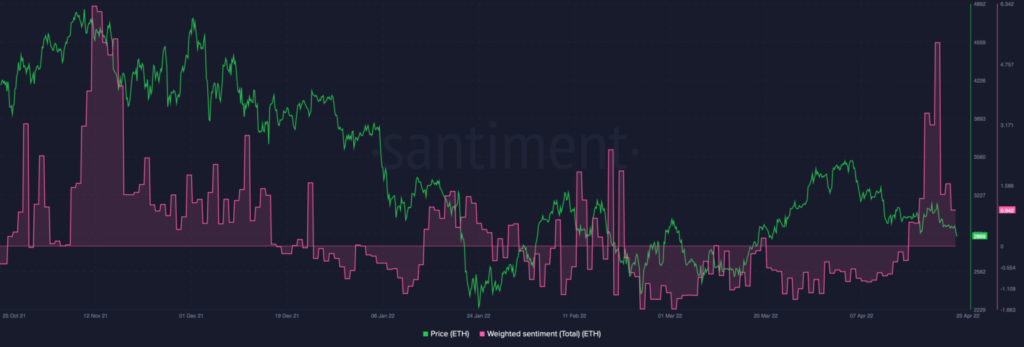

Data from Santiment revealed that Ethereum investors are far from drowning in tears, despite the price crash. In fact, weighted sentiment for ETH showed investors descending from euphoric highs, like those last seen before the December 2021 crashes. This could have helped trigger the latest price decline. Even so, the weighted sentiment was at 0.942 at press time, suggesting further declines could be on the cards.

That being said, ETH supply on exchanges was still falling at press time, indicating that investors aren’t likely to be drawn into a drastic sell-off en masse. A continued fall in ETH on exchanges or ETH being staked could help raise the price of the asset and initiate a bull run, with time.

A load of “whataboutery”

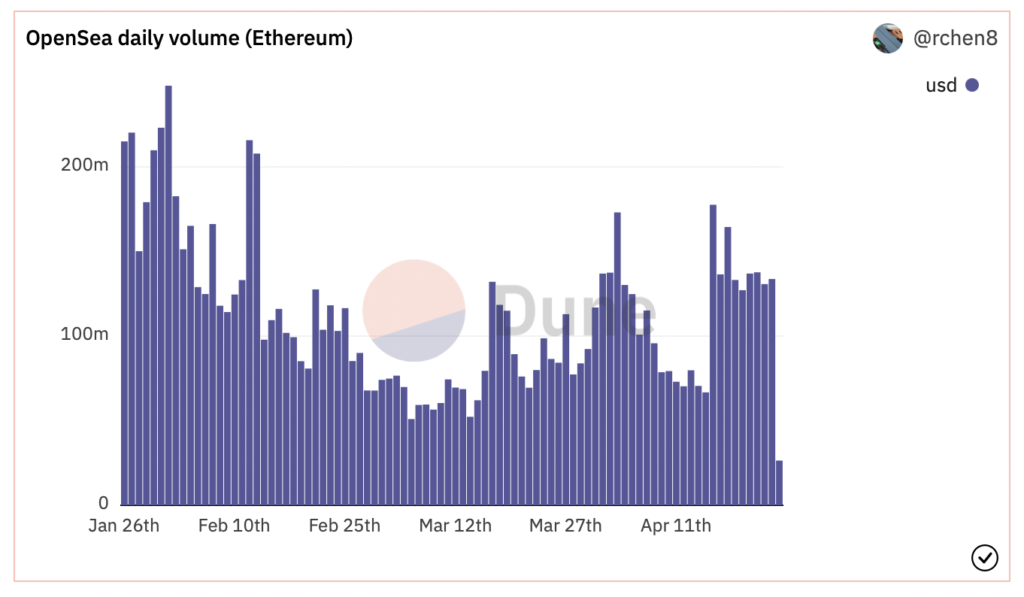

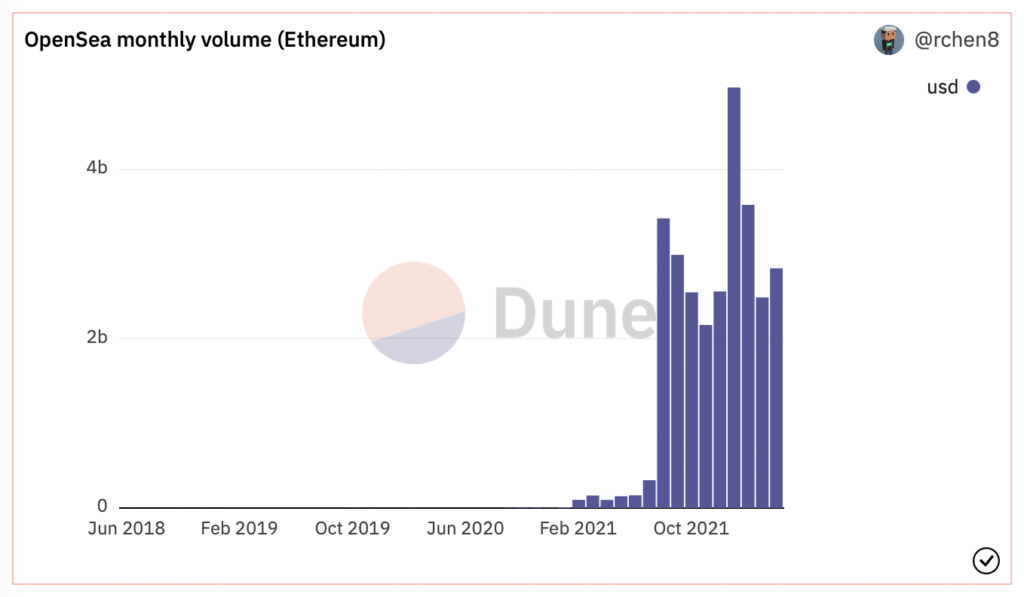

So Ethereum might be able to hold its own even in a turbulent market, but what about the still booming NFT industry? Will it survive a red market? Although there are reasons for concern, a positive sign is that the Opensea [Ethereum] the monthly volume has already exceeded the levels reached last month.

Adding to that, there has been a strong recovery in daily trading volume since mid-April. If this goes on, it could help both the NFT industry – and the Ethereum ecosystem.