Ethereum has played a significant role in the mainstream adoption of cryptocurrency and DeFi in general. Ethereum’s market capitalization is currently $340 billion, indicating how much the cryptocurrency grew in the last decade. That growth also incorporated ETH’s holders who played a vital role in this long journey.

Nothing without you

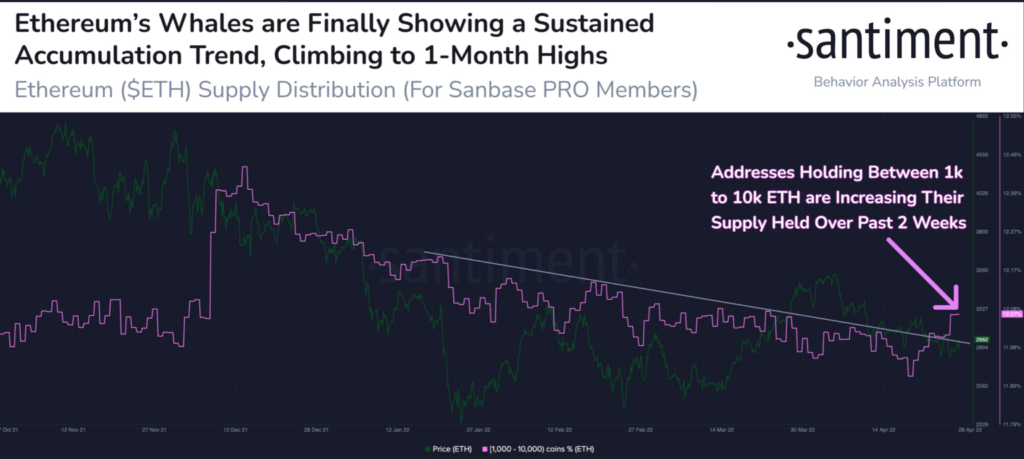

At press time, major ETH stakeholders are showing impressive accumulation according to data from Santiment. These speakers added 142k more ETH to “their bags in the last 10 days”. The chart below presented a graphic illustration of this shopping spree.

That analytical firm further added,

“After a long dump going back to mid-December, this is the most sustained level of accumulation we’ve seen in over four months.”

Ethereum addresses have steadily increased since last year. Data revealed that the Ethereum network gained 18.36 million addresses with a balance greater than zero in 2021. This equates to an astonishing growth rate of 1.53 million new addresses per month.

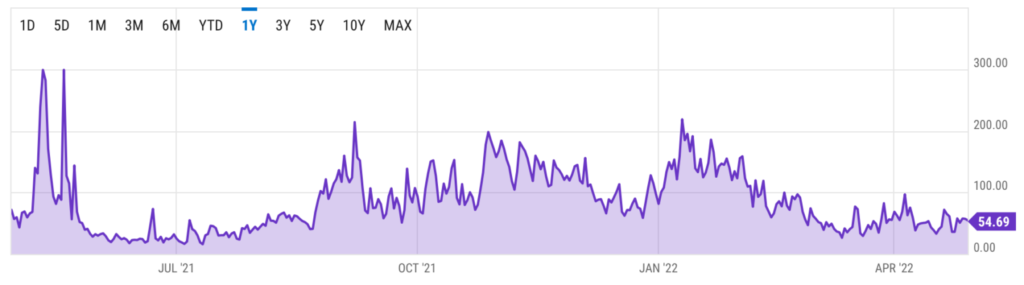

Even now, at press time, the number of addresses witnessed an exponential increase as showed the graph below.

Now, this gradual increase, despite growing competition in the crypto market, made sense. According to IntotheBlock data, 70% of ETH holders saw massive gains while 28% remained underwater. But overall, this echoes a bullish scenario for ETH holders of the past and can be expected to continue in the future as well.

In addition, the Ethereum upgrades (Merge) have already started reducing the gas fee and increasing the speed of the chain. ETH’s average gas price, at press time, stood at 54.69 Gwei, a significant decline from the recent past. This is a change of -4.29% from yesterday and -23.87% from one year ago.

Fair to say, with the upcoming ‘Merge’ and the declining fee structure, it would witness some traction growth as new investors would consider joining the ecosystem.

From North to south

However, not everyone seems to agree with this narrative. Some Ethereum (ETH) holders reduced their exposure to protect against volatility in the crypto markets at the start of the weekend. The top 100 Ethereum wallets have seen significant outflows of ETH in the past 24 hours. According to Whalestats, these dominant holders have sold approximately $783,734 in ETH over the past two days.