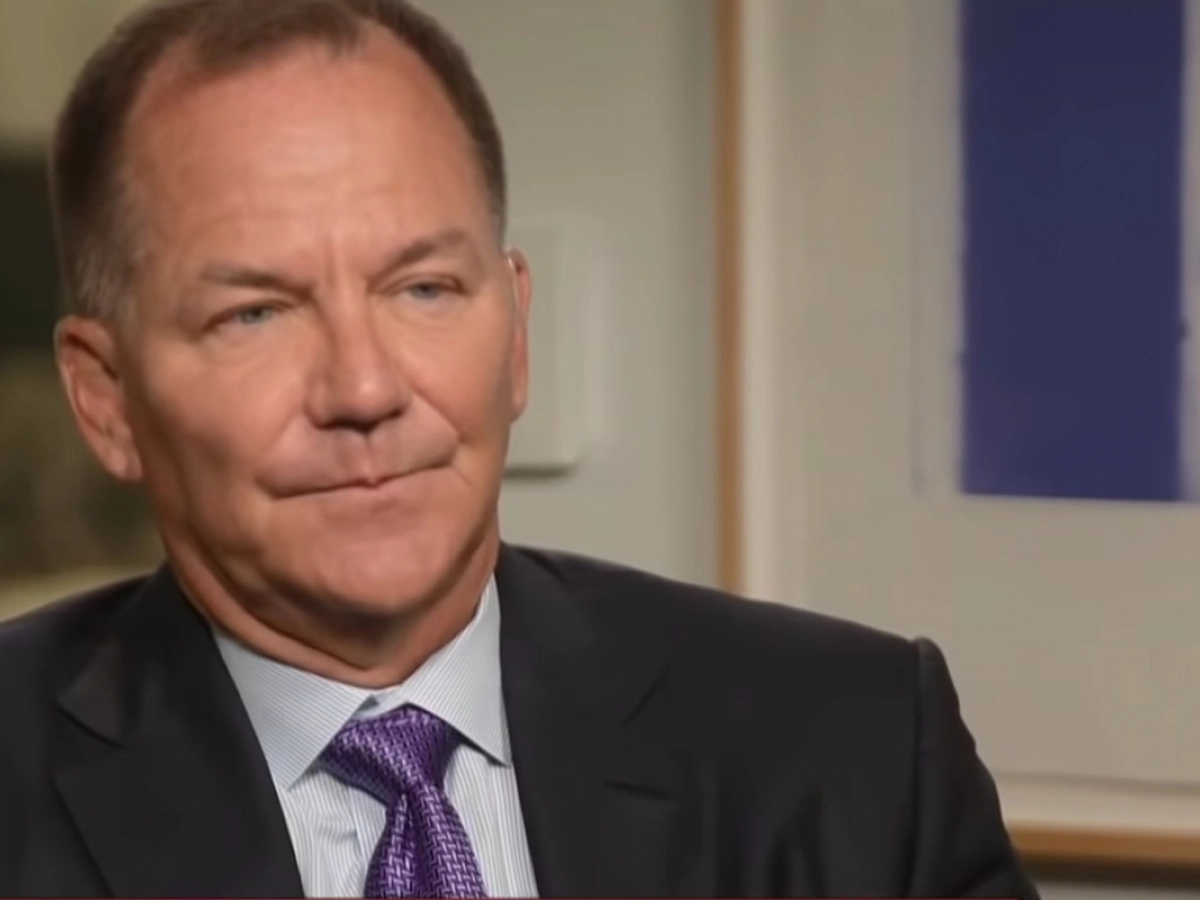

Paul Tudor Jones says a lot of intellectual capital is flowing into crypto and that bonds and stocks are the least reliable assets now

As the US Federal Reserve discusses raising interest rates by half a percentage point, the biggest hike in 20 years, billionaire Paul Tudor Jones says it might be a bad idea to own stocks and bonds, but he still believes in bitcoin and crypto. .

In his interview with CNBC’s Squawk Box show, he shared that he still holds Bitcoin and is bullish on it.

“Capital preservation is the only thing possible now”

Paul Tudor Jones referred to the inflation that plagued the United States throughout the 1970s. At the time, it first reached 5.5%, then gradually increased to 14.4% and fell back slightly only in 1980.

Back then, Jones says, there were no assets that were able to bring any positive returns—not even gold.

The investor shared that stocks and bonds are the last thing to hold these days and the only possible thing to try is to preserve capital, trying to lose as little as possible during rising inflation. This year, it has already reached 7%.

He stressed that most likely, currently, we have entered another rare period when it will hardly be possible to make money on the market.

We are going through one of those very difficult times where simple preservation of capital is the most important thing we can aspire to. I don’t know if this will be one of those times when you’re actually trying to make money.

“It’s hard to not want to be long on crypto”

When asked by the host whether he is still long on crypto, Jones admitted that he is still “modestly invested” and believes that the current rate hikes are going to ensure a bright future for his crypto investment.

He also added that “it’s hard not to want to be in crypto for a long time,” presumably meaning Bitcoin, as intellectual capital is flowing into this space.

Paul Tudor Jones bets on BTC versus gold

In October 2021, Jones called Bitcoin a better inflation hedge than the traditional asset used for this—gold.

According to him, at the time Bitcoin was winning the race against the precious metal as the economy was largely moving towards a digital world.

Back in October last year, gold was down 7% year-to-date and Bitcoin was up 121% over the same period of time, trading at $65,992. The all-time high was reached pretty soon after, when BTC hit $67,600 in November.

In November 2020, Paul Tudor Jones announced that he had converted 2% of his net worth into Bitcoin.