Bitcoin (BTC) has not been so stable since mid-November 2020; what does this mean for traders?

Bitcoin (BTC), the flagship cryptocurrency, still fails to get rid of its bearish channel that started in November 2021. At the same time, its volatility is hitting one local low after another.

Bitcoin’s volatility targets new lows: Check the data

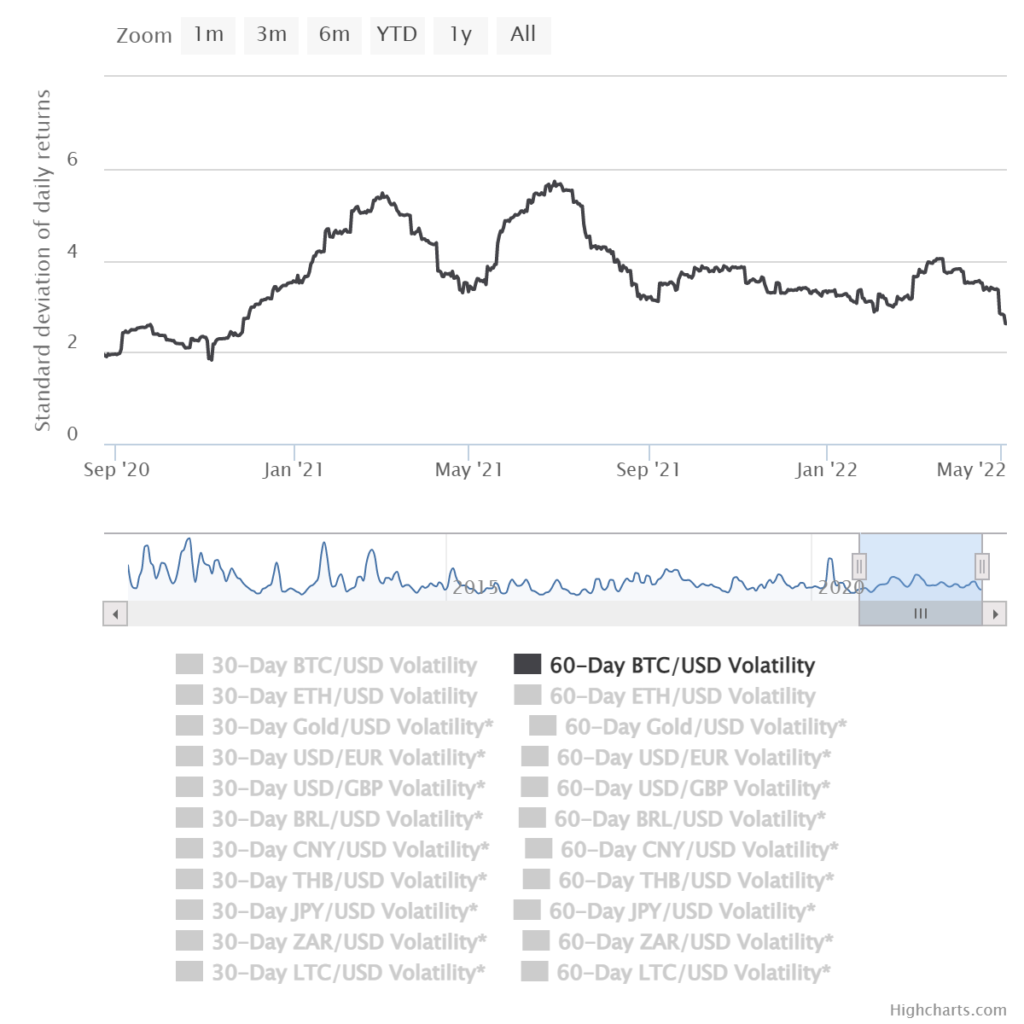

According to data shared by the Buy Bitcoin Worldwide portal, Bitcoin’s historical volatility is at 18-month lows. Its 60-day estimated average value dropped to 2.62%.

The last time Bitcoin (BTC) volatility was this low was in November 2020, when the orange coin broke above $10,000 for the first time in this bull cycle.

Thirty-day volatility dropped to a local low on April 27, 2022, but now shows signs of recovering.

Much like the VIX for the stock market, the Bitcoin Volatility Index (BVOL) displays how much the Bitcoin price fluctuates on a specific day, relative to its price.

The last spike of Bitcoin (BTC) volatility was registered in July, 2021: on the 30-day timeframe, the flagship crypto was twice as volatile as it is now.

‘Extreme Fear’ Still Dominates Market as BTC Surges Above $39,000

Meanwhile, after touching the local low at $37,400, Bitcoin (BTC) started to rally. Following the most bearish April ever, the flagship cryptocurrency rallied to $39,100.

However, traders are not so excited by this pale recovery. Alternative’s Crypto Fear and Greed Index sits at 21/100, which means “Extreme Fear.”

This level is very low: in bearish 2022, Bitcoin sentiment only fell into the “10-20” zone twice in January.