Just a day after crashing 7% along with other major cryptocurrencies, Ethereum is back again in the news. There is growing uncertainty over its short-term prediction with different data sets suggesting more confusion for investors.

Glassnode posted two metrics on its Twitter feed suggesting impending turbulence for Ethereum. The delay of ‘Merge’ has led to negative market sentiment dominating the Ethereum community. However, the Ethereum Foundation has since launched a roadmap for the same to ensure some community support.

Data briefing

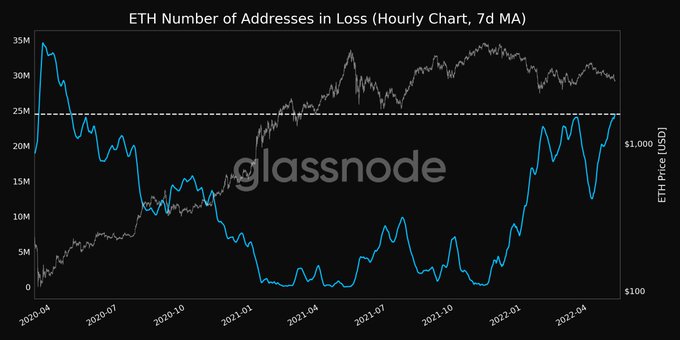

Ethereum reached a new landmark recently which shouldn’t come off as good news for the community. It crossed a two-year high of ‘Number of addresses in loss’ earlier on 7 May. At press time, the total number of addresses in loss stood at approximately 24.5 million which is the highest since May-June 2020.

Another worrying metric is “miner’s income” which just hit a 9-month low of $1,476,333.1. The previous 9-month low of $1,487,318.95 was seen on March 13.

With their profit margins squeezed, miners are forced to sell their tokens under pressure. This further increases the selling pressure thereby creating an overall bearish sentiment in the market.

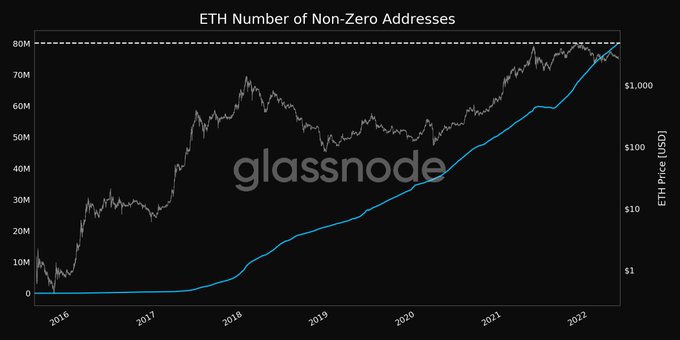

Additionally, the “number of non-zero addresses” reached an all-time high on May 7 at 80.1 million addresses. This is a particularly important metric since its reading hints at anticipated future bullish momentum.

Hear it from the expert

As per Business Today, Vikram Subburaj, CEO of Giottus Crypto Exchange, warned investors of temporary market volatility. He said,

“Crypto markets are going to be volatile until investors, who are currently risk-free, turn to risk mode. In the coming months, the surge in the DXY Dollar Index must reverse before there are indications of a rally in stocks and crypto. Bitcoin and other crypto-assets can potentially lose up to 20% or more from current levels before investor funds start flowing into the asset again.

He further ended on a positive note in terms of long-term investment. This is a vote of confidence for the downtrodden investors after a rough couple of weeks, as he said,

“Patience will be essential to allow existing portfolios to consolidate and grow. We predict a strong fourth quarter of 2022 for crypto assets.