Ethereum, like most cryptos in the industry, is yet to recover from the stormy market conditions of the past week. At the time of writing, for instance, ETH was trading at $2,028, well below its ATH less than a year ago.

In fact, the altcoin is down 0.4% in the past 24 hours and 23% in the past seven days, according to CoinGecko. On the charts, the Awesome Oscillator (AO) also confirmed the bearish alt move with the red histogram peaking below the zero line.

Hold on! There is more…

While the price has been acting like that, what do the metrics backing it say?

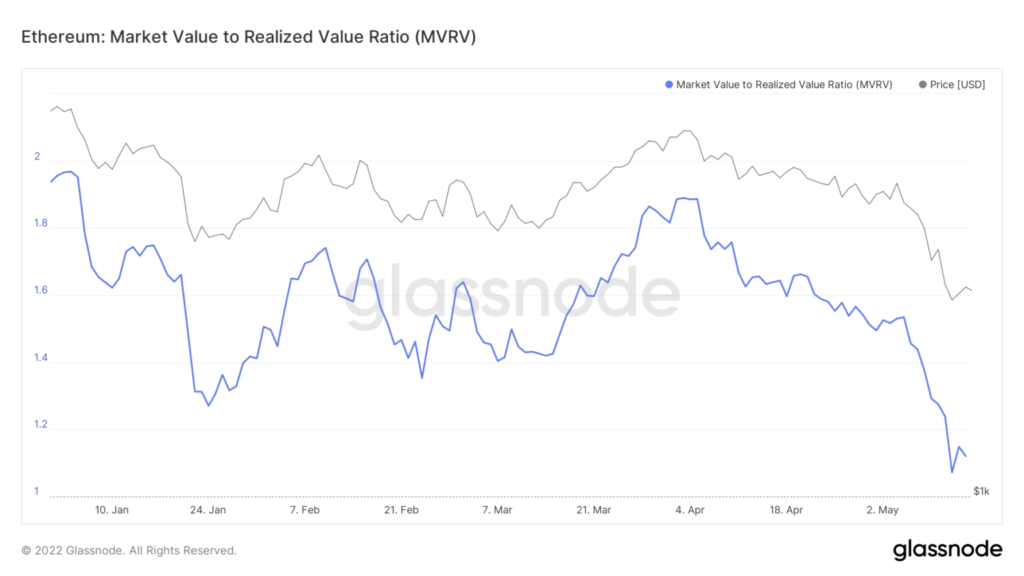

Well, according to glass knot, the number of addresses in profit hit a 16-month low of $48,834,479.232. The MVRV ratio fell from 1.14 on May 13 to 1.11 on May 14. This discovery apparently highlighted how the altcoin is held at a loss by its holders.

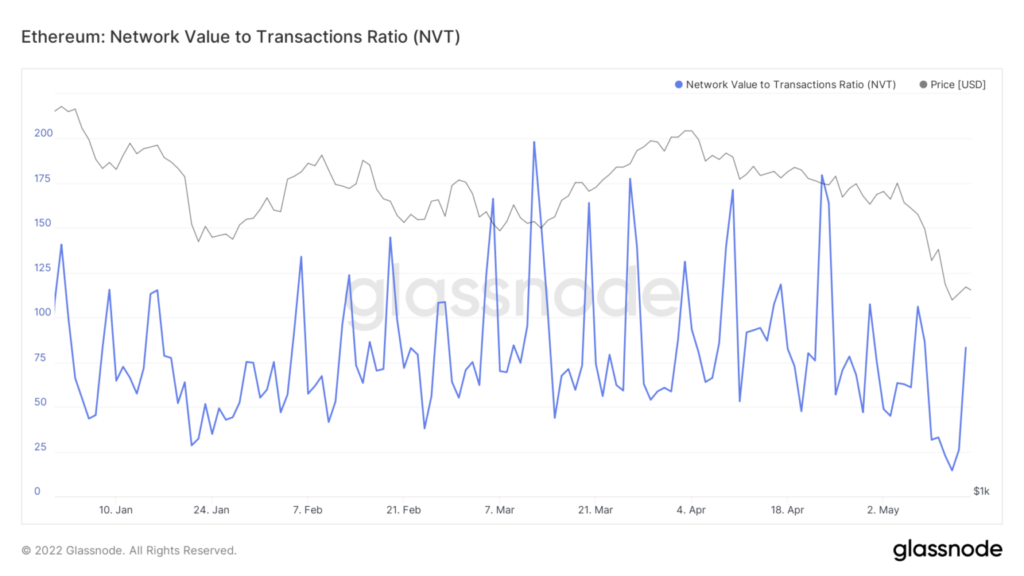

The NVT ratio for ETH stood at 83.19 on 14 May after appreciating from 14.51 on 13 May. A higher NVT ratio again strengthens the notion of the ongoing bearish market.

In addition, the number of “Send to Exchanges” addresses also hit a one-month high of around 3,987, according to glass knot.

Is recovery on the cards?

With the current state of ETH, the only beacon that may lead to some difference is the much-anticipated “Merge.” Ethereum’s promise to build a more secure, energy-sensitive, and efficient system may have created some buzz and triggered price changes. Alas, a temporary phase might not be enough to affect the performance of the token in the long run.

The merger, once expected in the first quarter of 2022, has now been pushed back to the third or fourth quarter of 2022, according to the official website. However, the complicated nature of the transition from PoW to PoS, as well as the looming uncertainty as to whether current prices and the gas fees in question would be lowered, may act as catalysts for investors.

The future looks like…

Tim Beiko, a core developer for the Ethereum Foundation, stated his reasons for the ongoing delay via an interview with Consensys. He claimed,

“Ethereum has never gone down or stopped. When we designed the merger, it was essential that this process of moving from proof of work to proof of stake happened without any downtime on the network. »

He further pointed out that the Merge will also drive the network’s economic security.

However, with frustration building among investors thanks to the aforementioned delays and ETH’s price action, recovery may just be a long way away.

Top of Form