Yesterday, the 17th of May, the cryptocurrency market was in green with Bitcoin and other major cryptocurrencies trading positively. However, this bullish trend didn’t last for long as the bearish trend had escalated during the TerraUSD stablecoin (UST) crash.

The world’s first cryptocurrency by market capitalization which reclaimed $30,000 a few days ago has fallen further and is trading around $29,000. This has also affected other major cryptocurrencies bleeding the crypto market.

Meanwhile, Tim Frost, Yield App founder, and CEO put forth his thoughts via email saying that the crash led by Terra’s UST has put an end to a momentous bull run.

He further added that the market was down 54% from its all-time high and would not recover anytime soon as the market appears to have an extended bear market.

The increased US inflation is also one of the reasons for the crypto market crash. The U.S central bank Chain Jerome Powell during The Wall Street Journal’s Future of Everything Festival held yesterday stated that it’s important to restore the price stability and added that he is positive about the Fed curbing the inflation without affecting employment.

Investors’ Stablecoin Preferences Are Changing

The crash of LUNA and UST still hangs over the global crypto market. This crash not only affected the majority of the cryptocurrency price, but also the investor’s confidence in the stablecoin and its value.

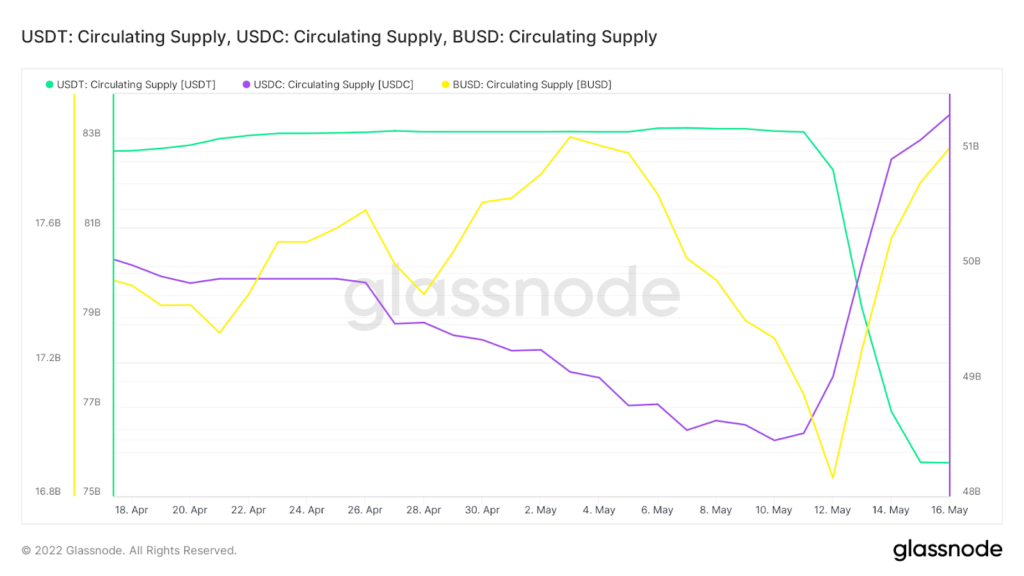

There is an inverse relationship between the issuance of Tether (USDT) and USD Coin (USDC) along with Binance USD (BUSD) and this is depicted by Glassnode data.

The data indicates that Tether tokens are more in circulation as they are exchanged for cash whereas USDC and BUSD are used due to demand.

According to Glassnode analyst, James Check, the USDT redemption was around $7.5 billion, whereas the USDC supply increased by $2.64 billion and BUSD by $1 billion. Hence the total was around $3.64 billion in supply expansion and $7.5 billion in contraction which meant a net inflow of $3.76 billion.

James Check also believes that large traders took advantage of this moment to head into the USDT peg in hopes of generating downside fears and it happened.

USDC has a long way to go before it ever gets a chance to flip Tether. However, with decreasing confidence over stablecoins, traders are more likey to lean towards USDC and BUSD more than Tether.