Bitcoin price failed again at the $30,000 level. The BTC price even dropped to $29,000. However, altcoins are in even worse shape,

BTC/USD is now more than 55 percent lower than its all-time high, which was set in November 2021. What, on the other hand, does this latest crash indicate for investors? Is there any hope for a comeback?

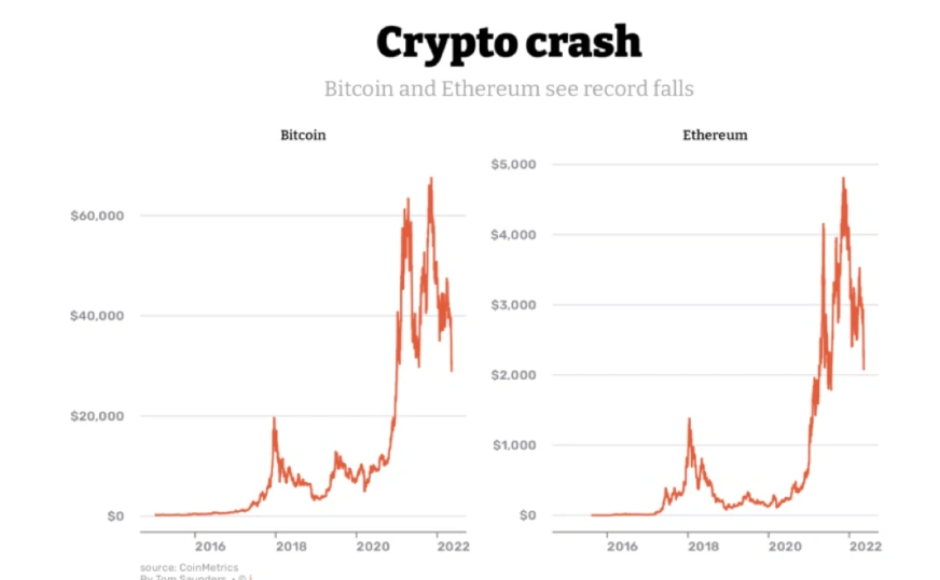

The bitcoin market crash hit coins the same way as seen in the chart image, but how does this trigger the downtrend?

Ultimately, trader perceptions of cryptocurrencies have shifted as a result of the slump. Investors have been increasingly wary of heavy financing as inflationary levels have gone up, and the crypto market’s unpredictability tends to create an ever-present danger to holdings.

The sentiment of optimism surrounding Bitcoin has been bolstered, according to Maxim Manturov, head of financial advice at Freedom Finance Europe, by favorable short-term trading circumstances caused by the Covid-19 outbreak.

Manturov explained,

“If we compare the situation from summer 2021 – when Bitcoin grew on inflation expectations and was to some extent a temporary digital alternative to gold – and the current situation, one important difference is worth highlighting. On the 15th of March, the Fed started the process of raising rates and ending QE.This has been the fundamental reason for all Bitcoin and cryptocurrency growth in the last two years. And with higher rates, an asset class like cryptocurrency may be less attractive.”

Given the latest slump, once-strong companies like Luna have lost % of their fair value, plunging from $6.75 to one or two cents, wiping out the accounts of many investors. The asset’s relationship with TerraUSD (UST), a dollar-pegged stablecoin, triggered the downfall of Luna’s instance. Luna’s price plummeted as the UST decoupled from the dollar on the eve of the crash. Luna’s market value has gone from $40 billion to around $200 million.

Despite the fact that Luna’s downfall was caused by a problem that had no bearing on the broader marketplace, it’s logical to assume that the cryptocurrency’s precipitous drop influenced more rapid business sell-offs in current days.

Bitcoin’s Difficulty Breaking Out of Established Markets

An additional factor contributing to the difficulties of the crypto market is its inability to distinguish itself from its own regular stock markets. This could be a source of annoyance for crypto fans who feel that because currencies are built on the blockchain, they should be decentralized and therefore resilient to price fluctuations around the world.

Cryptocurrencies have been found to be inextricably related to the stock market in previous years. In March 2020, when the Covid-19 outbreak drove global markets to plummet, Bitcoin plunged 57 % as a result of the sell-offs. Similarly, when markets rebounded and saw a huge gain, Bitcoin did as well.

The future of crypto has faded as the excitement around the stock market return fades. As the Federal Reserve and other central banks raised key interest rates to boost prices, investors turned away from crypto, preferring to avoid the notoriously unpredictable asset protection ecosystem.

Bitcoin’s current decline follows the Dow and Nasdaq’s greatest daily dips since the collapse of 2020. The disconcerting news of Russia’s incursion on Ukraine has compounded inflationary concerns, resulting in increased volatility, supply chain challenges, and skyrocketing oil costs.

This situation has been aggravated by the recent resurgence of Covid-19 in China, which has raised financial concerns across Asia. While cryptocurrency proponents believe that Bitcoin will eventually break away from the stock market, there is no denying that the two are currently intertwined.

Is it time for a crypto winter?

One of the most recent drops in the cryptocurrency market has been extremely difficult for investors to deal with, with speculation rising that the market is about to enter a new ‘crypto winter.’

Cryptocurrency storms are common and normally occur in the 4-year intervals between Bitcoin halving cycles, the most recent of which will be in May 2020. Between 2018 and mid-2020, the last winter crypto s is produced.

Although the term has detrimental consequences, a crypto winter is just a time of slumber for many cryptocurrencies, during which values remain stable and there are few bullish jumps to celebrate.

Considering the fact that crypto winters don’t really have to be a terrible sign, they can potentially help the cryptocurrency industry go from strength to strength. Extended hours of standing still, for example, help filter out really solid, sustainable, and productive crypto projects, blockchains, and decentralized finance propositions for people to invest in when the bull run reappears.

Although the crypto winter suggests that Bitcoin’s value will struggle to build the pace for price rises for a long time, there’s really no reason to suppose that BTC won’t be able to recover to its prior highs in the near future.

The continued adoption of cryptocurrencies by organizations indicates that the best of the cryptocurrency market is yet to come.