“It’s not about the money- It’s about the game.” The composite character, Gordon Gekko from the 1987 film ‘Wall Street’ puts it well. And, perhaps, ETH option writers must be overjoyed to see that the game this time has been won by ETH traders who took a bearish stance in the past. In particular, the traders who got the momentum, direction, and timing right.

The crypto market is in chaos with ETH trading at a price of $1,811 at press time. In particular, it has fallen by 11.19% over the past seven days. Now you can ask what’s in it for investors.

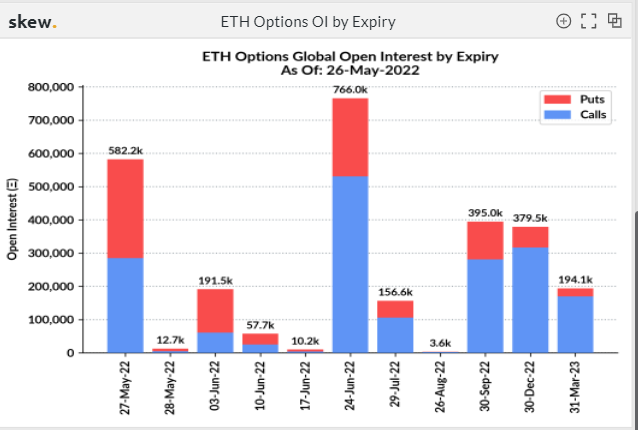

Well, a total of 582.2k outstanding options contracts are set to expire on 27 May. The comparatively high number of open interest for options on 27 May states that new money can be expected to flow into the marketplace. Thus, hinting that the current trend might continue for a little longer.

The zero-sum game couldn’t be more glorified as put options outweighed call options at the May 27 expiry. This clearly shows that a portion of the market participants sensed the bearish aroma and took their positions accordingly.

A deep dive

On closer observation, one can find that the 27 May has the second-highest contract expiration after the 24 June 2022 expiration of 766.0k contracts. As it were, it implies that considerable volatility in ETH’s spot prices can not be ruled out.

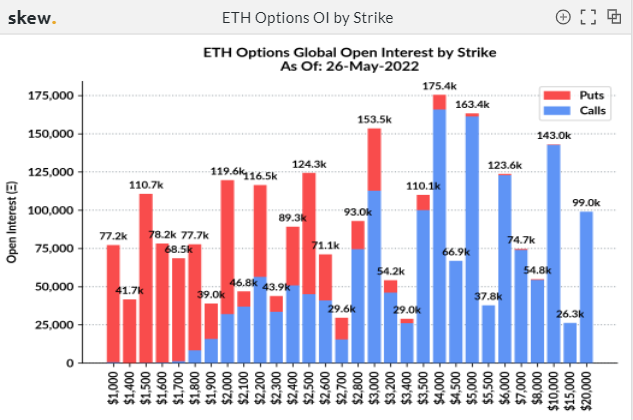

Now the second thing to consider is the strike price. Since May 26, until the strike price of $1,700, call option contracts are no longer visible. However, it looks like the $1,800 mark is giving traders hope, even though the number of call options contracts remains well below the 25,000 mark.

Interestingly, at the strike price of $2,100, call options starkly outweigh the put options. Peradventure, signaling that traders at that price point are too exhausted to take a pessimistic stance.

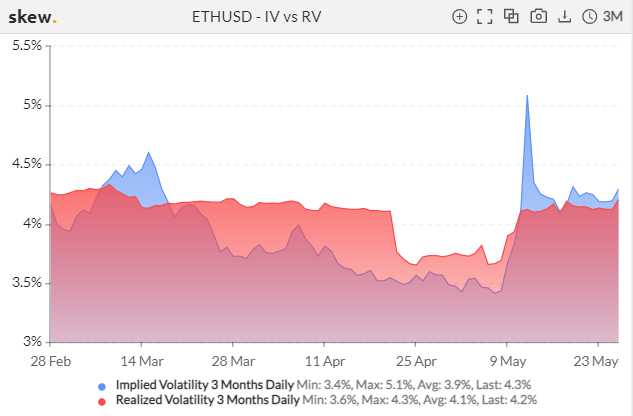

Moreover, implied volatility as of May 26 was close to historical volatility. Thus, hinting that ETH may be limited for a few days before experiencing the heat of volatility. Reading the Relative Volatility Index (RVI) on the price chart confirms this narrative.

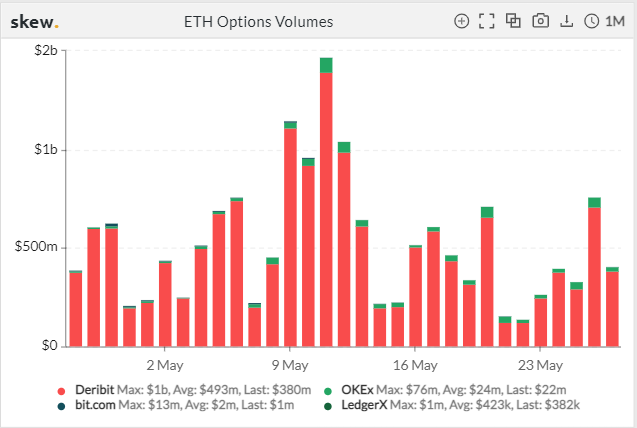

For ETH derivative traders, it is also important to look at the ETH options volumes which seem to be declining after 11 May. This could possibly mean that investors are not very optimistic about the king altcoin’s performance in recent days. Most of them are waiting for a bull run ahead to take their respective positions.

Additionally, at the time of this analysis, the MVRV ratio (30D) was -15.59%. Thus, indicating that 43% of ETH holders are currently at a loss. And, the market sentiment for the token is mostly bearish.

Considering the above-mentioned metrics, it can be said, ETH traders have a lot of future money-making options with the expiration of 582.2K contracts on 27 May.