The altcoin market crashed significantly in the month of May. Ethereum, the largest altcoin extended its decline below the $1,820 support against the U.S Dollar. At press time, ETH suffered a fresh 11% correction as it traded below $1,7300.

What can investors expect next?

bedtime stories

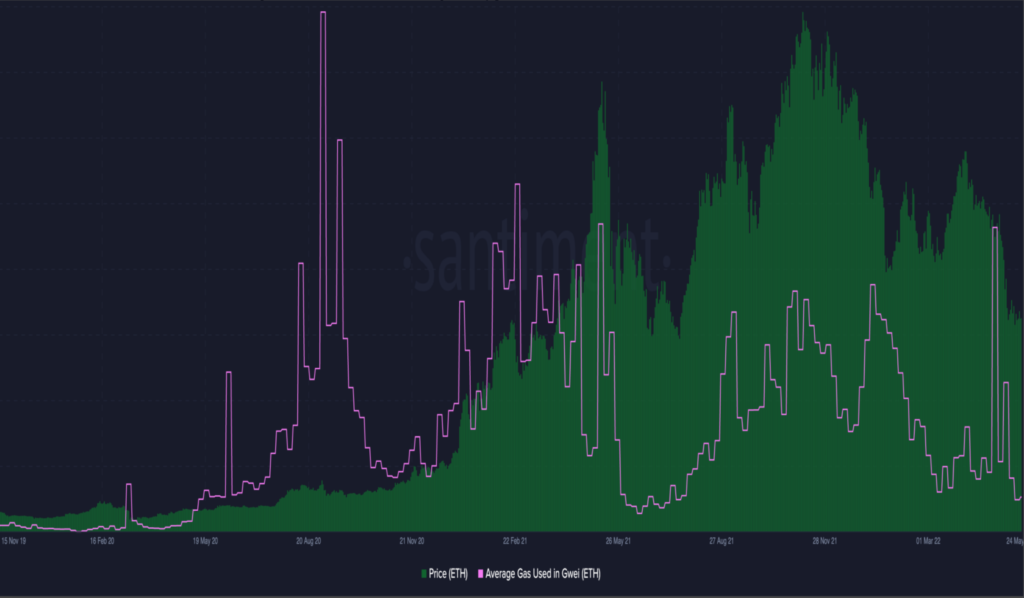

Ethereum’s fee structure is steadily declining as the network approaches “merger”. Right now, the average ETH fee costs traders just $2.54 per transaction – the the lowest ETH cost level since July.

While this might sound like a positive development, there are some concerns attached to it. This also showcased a declining demand/traction for the largest altcoin within the NFT, the DeFi domain.

Another attribute of slow/declining development could be the arrival of the hibernation phase. On May 27, on-chain data provider Santiment reported:

“Ethereum continues to show extreme low fee levels, indicating very minimal activity and hints of stagnancy and fear. This hibernation behavior also applies to ETH‘s often paired stablecoin, DAI.”

Here is a graphic representation highlighting this narrative.

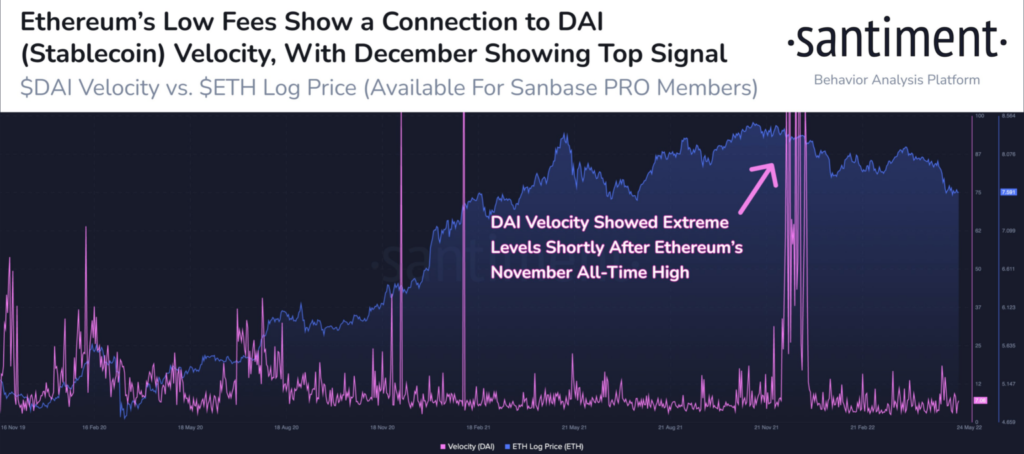

Low fees mean very little activity and no one is interested in doing anything. Is there a connection with the speed of the stablecoin (say DAI)? Well, Santiment’s blog gave its opinion:

“It looks like velocity (a measure of how quickly money is circulating in the crypto economy) has always decreased when we went to the top. Quite low now.”

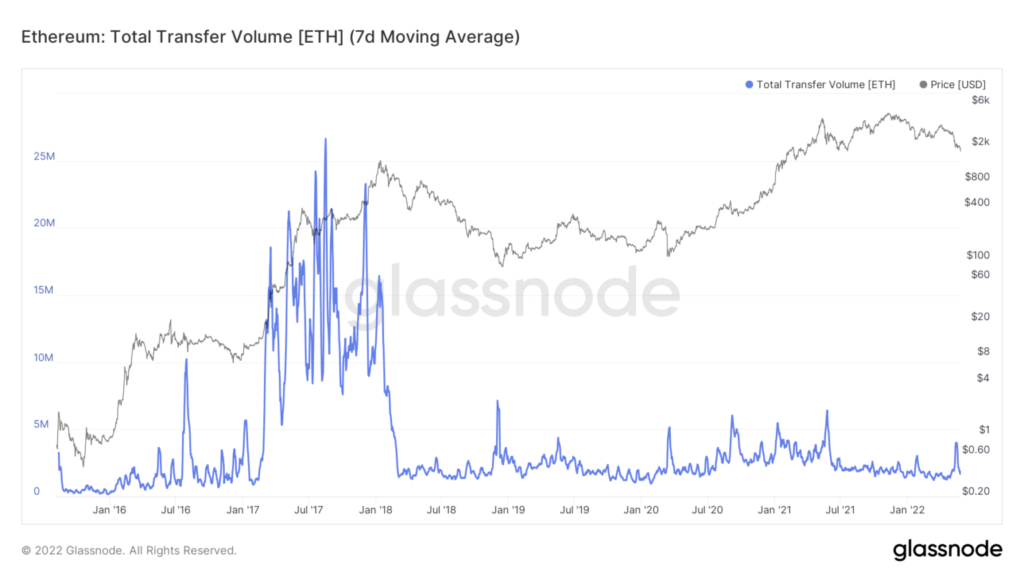

Looking at these two graphs, an image of hibernation comes to mind. Additionally, trading volume on a seven-day average fell to an all-time low. Thus, substantiating hibernation claims.

The grass is greener here

Here’s another way to look at it. This hibernation from investors is actually protecting them from any severe losses. Price movement will eventually recover but exiting at the wrong moment would lead to the investors losing out on profits. In fact, at present, 53% of holders still saw profits.

The bearers have maintained a “holding” culture despite the setbacks. Data from Glassnode showed ether exchange withdrawals were down.

This metric had held up through multiple bull rallies and went against the grain as investors chose to move their ETH holdings out of exchanges. It signaled a high accumulation pattern among investors that showed that sentiment remained firmly the positive as holders refused to sell.