The crypto market crash of 2022 has led to decreased investor interest in digital collectibles by the global NFT population.

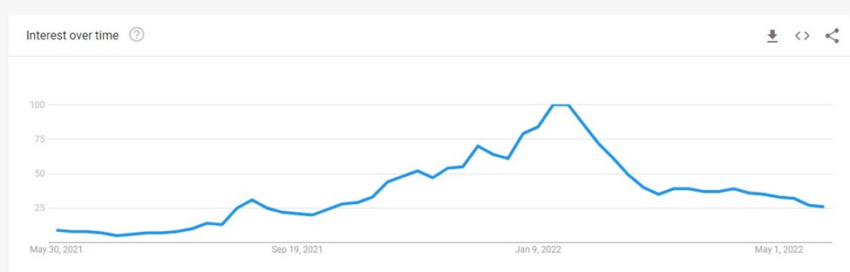

Interest in non-fungible tokens (NFTs) dropped to new lows in May 2022. According to Be[In]Crypto research and Google Trends data, interest in NFT-related topics by the global population has dipped.

Interest over time comprises the number of Google searches in NFT content represented by a number between 0 and 100. A value of 0 or close to 0 means there is little to no interest. On the other hand, a value of at least 50 means that the term constitutes a huge part of searches by the global population.

The term “non-fungible token” reached a value of 26 in the last days of May. This is a decline of 74% from the peak of additional interest of 100 reached in January 2022.

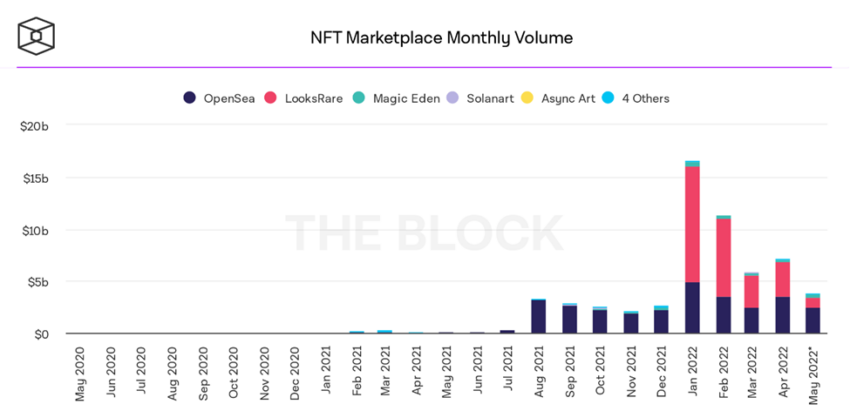

In January 2022, the major NFT marketplaces’ monthly volumes reached an all-time high of $16.54 billion. In the last days of May, the total monthly volume was approximately $4 billion, equating to a 75% decline from January’s volume.

Some of the NFTs that contributed to the January milestone include the Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Axie Infinity.

In the last days of May, BAYC NFT sales volume was in the region of $200 million, a 41% decline in four months.

As of January 2022, the sales volumes of Axie Infinity and Mutant Ape Yacht Club were approximately $126.49 million and $252.33 million, respectively.

The bearish market dramatically slashed these values in the second quarter of 2022.

Axie Infinity recorded a total sales volume of $6.6 million, while MAYC made $163.96 million in May. Overall, Axie Infinity saw a decline of 94% while BAYC saw its sales volume fall by 36%.

Overall, issues that continue to trend on Google across the globe are inflation, Ukraine/Russia Crisis, gun control, and the overall crypto market crash (with prices and total value locked of digital assets) dominating search patterns.