Ethereum core developer Tim Beiko, on 30 May, confirmed the much-anticipated Ropsten testnet trial of the Merge ‘around June 8 or so.’ Thereby, aiding the largest altcoin shifting from proof-of-work to proof-of-stake consensus.

Interestingly, Ether’s price action is relatively unchanged despite the unexpected bullish announcement. Nonetheless, the incumbents continued their march through severe turbulence.

Keep it running

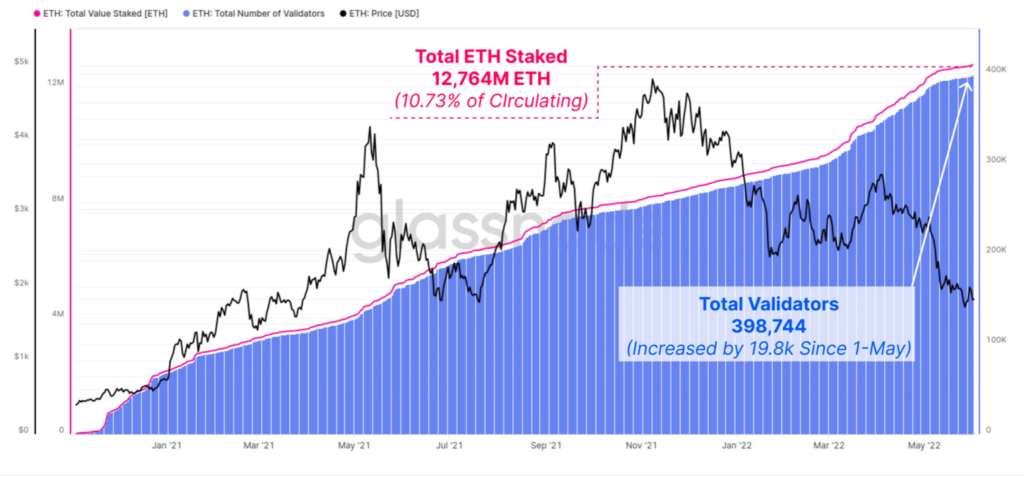

Participants in the Ethereum ecosystem have anticipated the upcoming ‘Merge‘ since last year. Capitalizing on this anticipation, the total value in the ETH 2.0 deposit contract reached an ATH. The amount of Ethereum staked on the Beacon Chain reached another milestone despite asset prices tumbling at an alarming rate. Here’s the fact sheet:

More than 12.764 million ETH was staked by 398,000 unique validators according to the total value of Glassnode staked in ETH 2.0. This represents 10.73% of the circulating supply – according to the graph below.

May, indeed has been a turning point for ETH’s stakers as 19.8k additional validators have staked, and came online since 1 May.

What would this mean for current incumbents? Well, regardless, ETH holders continue to dominate their acquisitions. According to data from Glassnode, the number of addresses holding at least 10+ ETH has reached an 18-month high. Farms (291,608) are still small, but certainly important.

This showcases faith and strength amongst holders remained undeterred despite some hiccups in ETH’s price. To add to this, 54% of holders witnessed massive gains to supplement the holding narrative.

Any concerns?

Well yes. ETH price itself did not perform much after slipping below the $2,000 mark. At press time, the largest altcoin suffered another 1% correction as it traded around the $1,800 mark. Additionally, $2.1 billion worth of ETH (a total of 1% ETH) has been transferred to exchanges recently, signaling some fear.