Roughly two months ago on April 11, the stablecoin economy was valued at $190 billion and was getting closer to surpassing $200 billion in value. However, after the Terra stablecoin fallout, the fiat-pegged token economy lost $16.31 billion in value since then. While that value was erased from the stablecoin market, stablecoins themselves represented 9.35% of the entire crypto economy’s net U.S. dollar value at the time. 61 days later, the crypto economy is worth roughly $1.15 trillion and the stablecoin economy represents 13.8% of that total today.

In 61 days, Stablecoin dominance fell from 9% to 13.8%

For the first time in history, three stablecoins were among the top ten digital currencies by market valuation 36 days ago, May 6, 2022. At the time, these were tether (USDT), usd coin (USDC) and terrausd (UST), but that was before the UST implosion.

While terrausd is gone, there’s still three stablecoins in the top ten today, as binance usd (BUSD) is the seventh-largest crypto asset as far as market cap is concerned. Two months ago on April 11, the stablecoin economy was valued at $190 billion but today, the valuation of the stablecoin market is now $159 billion.

On that day in April, the entire crypto-economy was valued at $2.03 trillion and today it is worth around $1.15 trillion. Even though the fallout from Terra’s UST has seen billions of dollars leave the stablecoin economy, it still dominates much more than it did when it neared $200 billion.

Stablecoins account for whole lot of trade volume as well, and at the time of writing, fiat-pegged tokens have seen $46.1 billion in trade volume, while all the crypto assets combined saw $71.6 billion. The data shows that 64.38% of all the digital currency trades today are swapped against stablecoin pairs.

For example, tether (USDT) trading accounts for 60.26% of global bitcoin (BTC) trading volume while BUSD commands 10.05%. USDT and BUSD are the top two BTC trading pairs at the time of writing, according to metrics from cryptocompare.com.

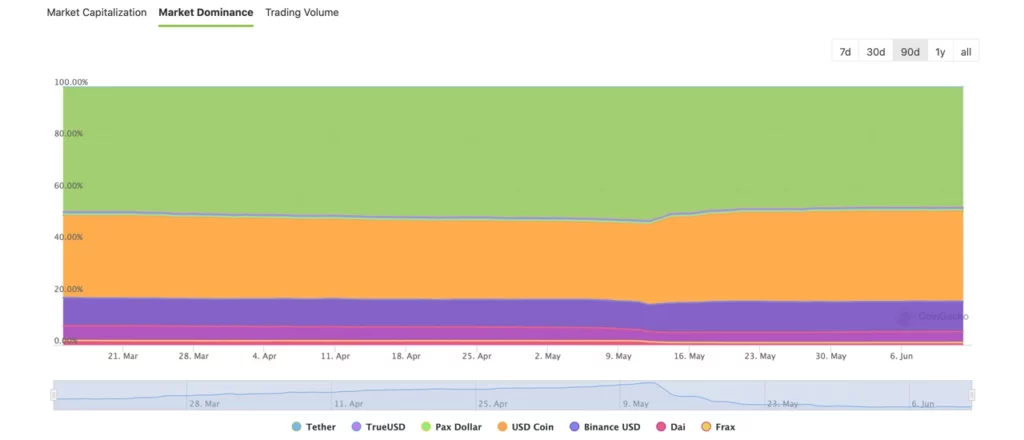

Tether (USDT) is still the king of stablecoins with an $72 billion market valuation that represents more than 6% of the entire crypto economy. Usd coin (USDC) is the second-largest stablecoin by market cap with $53.7 billion in value.

USDC dominates today with over 4% of the crypto economy and combined, USDC and USDT account for 76.92% of the entire stablecoin dominance of 13.40% . BUSD, on the other hand, makes up 1.58% of the entire crypto economy. That leaves just over 1% of the crypto economy that comes from stablecoins like DAI, FRAX, TUSD, and USDP.