The most popular Stablecoin, Tether(USDT) currently, appears to be in a deep soup as the market cap after shrinking constantly has reached a 6-month low. On the other hand, the USD Coin (USDC) gained huge popularity while the volume is recording a massive jump in the past couple of days. Therefore with the present momentum, the USDC may even surpass USDT to become the 3rd largest asset after Bitcoin and Ethereum very soon.

USDT had lost its peg shortly after the UST unpeg event when traders dumped huge amounts of USDT falling into the FUD. The rig quickly swung into action and burned 3 billion tokens to stabilize the peg. Undoubtedly, the peg stabilized but never regained its value back to $1 since then. Therefore, as many traders were currently expected to exit USDT, USDC now seems to have become a trader’s paradise.

So whether USDC reserves are currently safer than USDT?

It is a known fact that Tether is the most traded crypto asset each day in the market. But now, with a drastic fall, USDT could be de-throned shortly. The USDC market cap is constantly raising since the time when USDT tumbled. Currently, it is at an all-time high level of above $55 billion and short of another $14 billion to become the top 3rd asset.

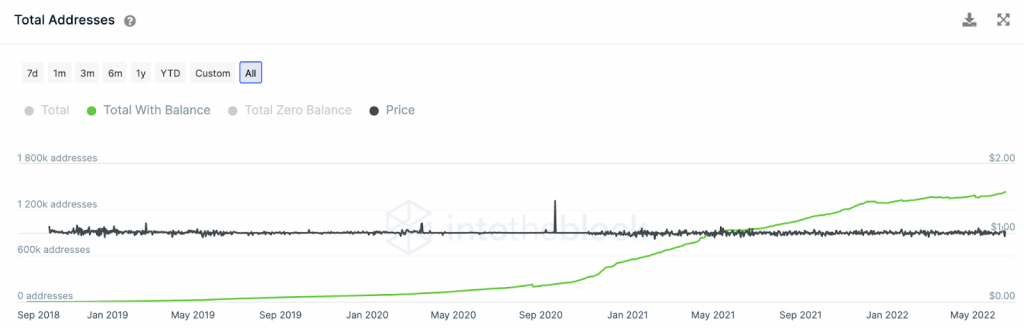

On the other hand, on-chain reports suggest that the USDC could reach this milestone in a short period of time. New addresses and active addresses have recently reached a high with the total number of active addresses currently at ATH levels, indicating growing user adoption.

Collectively, USDT’s dominance appears to have been threatened by emerging stablecoins like USDC and BUSD. Mainly due to the fact that USDC & BUSD are fully backed to USD reserves while USDT still lags clarity. Therefore in the upcoming days, USDC may gain huge dominance as the platform has now announced a Euro-backed USDC to be rolled out by the end of June 2022.