Big Bitcoin critic Schiff says he finally agrees with famous BTC evangelist on one thing about Bitcoin

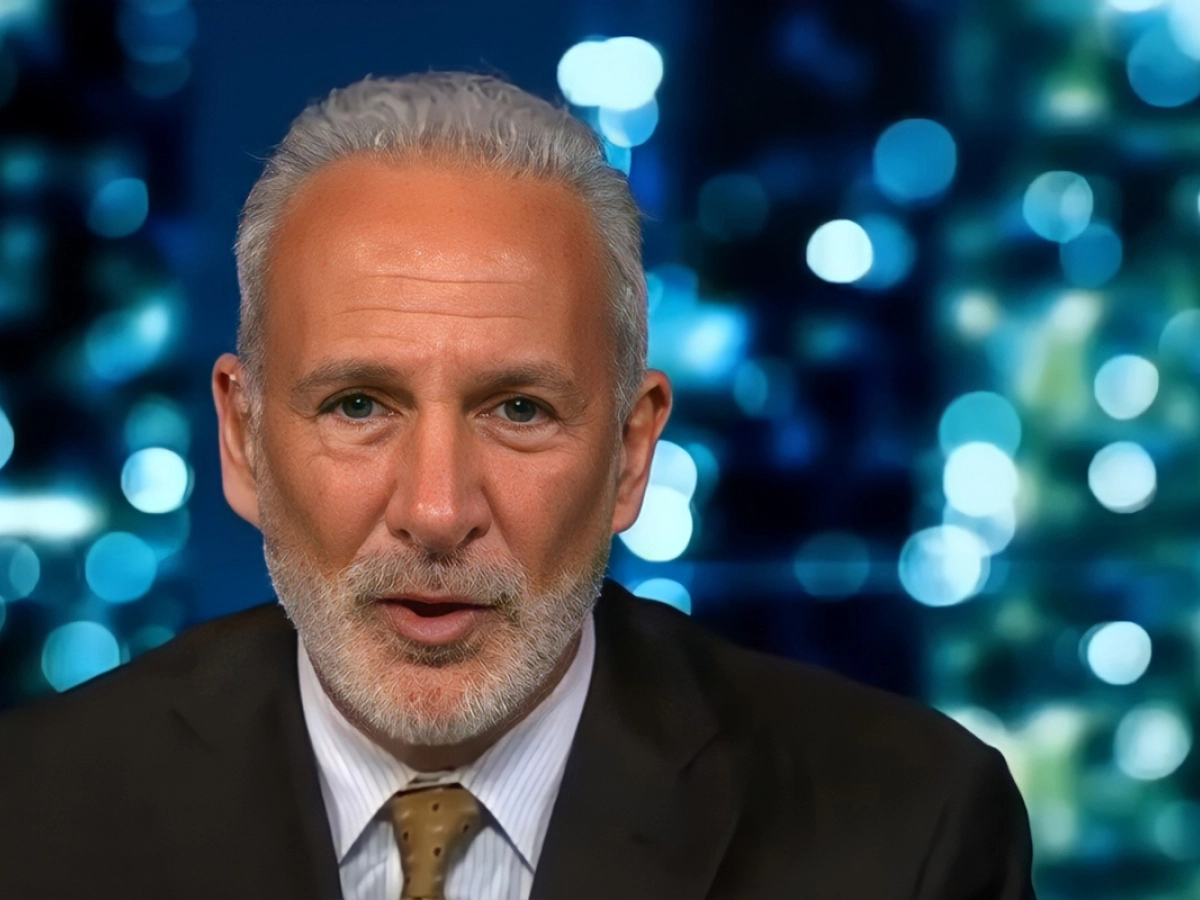

Prominent Bitcoin hater and SchiffGold founder gold bug Peter Schiff took to Twitter to share that he agrees with a point about BTC with BTC evangelist, CEO Michael Saylor from MicroStrategy, who was recently interviewed on CNBC.

In this interview, he stated that Bitcoin is now on sale, and Schiff agrees with that, according to his tweet; however, he does not agree with it 100%.

“I agree with Michael Saylor, Bitcoin is on sale”

In the interview covered by U.Today, Saylor said that as Bitcoin had (at that time) fallen to touch the $21,400 level, it was on the sell side and offered an ideal entry point. He added that BTC touches this price level every four years.

Bitcoin critic Schiff, who has been predicting BTC’s fall below $30,000 since January and has kept talking about the king crypto going to zero soon, could not help saying something about BTC in the context of Saylor’s interview either. The MicroStrategy CEO is believed to be one of the major influencers of the BTC community.

Schiff agrees that Bitcoin is on sale, but he says it’s not a buy. This is an “out of business” sale, as he put it. He thinks Bitcoin’s closing sale will happen soon and it will “be epic”.

“My predictions for BTC and ETH confirmed nearly 100%”

On June 16, Schiff tweeted that the prediction for the levels Bitcoin and Ethereum would hit as they are rolling down, and this was confirmed almost completely.

A few days before, the founder of SchiffGold tweeted that BTC would hit $20,000 and the second-largest crypto, ETH, would fall to $1,000. Reaching levels very close to these took BTC and ETH a few days longer than he expected, but even so Bitcoin “took $80 back to under $20,000 and Ethereum to under $20 of $1,000”.

In that tweet, Schiff again mentioned that he expects “a real crash” of crypto prices.

Schiff takes a hit at Grayscale

Goldbug Schiff also addressed Grayscale’s bitcoin-based shared GBTC down 78% from its all-time high and a 33% discount to NAV.

Today, according to Schiff, GBTC, once a popular product among investors, fell another 27.5%, trading at $12.60.

Schiff mocks Grayscale’s 2019 “Drop Gold” Bitcoin TV ad campaign. Since then, the company’s GBTC has skyrocketed and dropped to the levels mentioned above.

However, Schiff stated that since 2019, gold has been up more than 30%. He has asked Barry Silbert, crypto billionaire and founder of Digital Currency Group, parent company of Grayscale, to comment on that.