While end of downtrend might not be as close as we might have wanted, it is still somewhere in middle

The bear market always comes unexpectedly, with most traders and investors losing the opportunity to withdraw their funds and save some of their existing profits, resulting in a prolonged wait for a “bounce” that might not even not happen. But in Bitcoin’s case, it looks like we’ve reached the high point of the current bear market, according to glass knot.

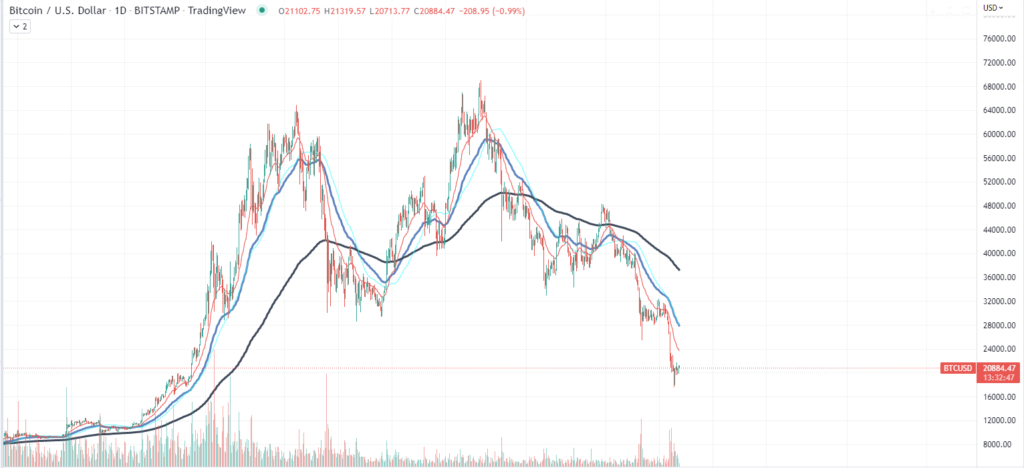

The historical analysis suggests that the average bear market lasts for around 400 days on Bitcoin, which plunged by around 80% in the downtrend. As you might already know, Bitcoin entered the downtrend after retracing from the ATH reached back in November, so the trend is at least 227 days old.

Although the end of the current bear market may not be imminent, it can most certainly be considered a “norm” as its duration has exceeded 200 days. If we compare it to other cycles, we should expect a slow comeback or consolidation in the months or even weeks to come.

Back in 2018, Bitcoin entered the consolidation range around the 360th day of the bearmarket after dropping to $3,800. The consolidation allowed investors and institutions to start accumulating BTC, which then became the main fuel for the bullrun started in 2019.

If the current cycles act similar to the trend of 2018, we could see a further fall and subsequent consolidation through October-November, then face a recovery of relief in 2023 when the ferocity of the Fed sets in. will calm down and the stock market will no longer be under pressure.

At press time, Bitcoin is trading at $20,850 and is yet failing to show any kind of upward volatility.