It has been hard for ETH traders to avoid panicking in the last few months as ETH continued to sell with no end in sight. The bears have been easing off their assault every once in a while, paving the way for minor relief rallies. However, even those have been short-lived and the bears continue to show their strength.

A similar scenario is currently unfolding after the latest ETH crash. The market had a few days of relative calm and some bulls. Investors could therefore expect ETH to experience another selloff very soon if the market continues on the same trajectory. Understanding the main sources of selling pressure is key to assessing the direction the market might take.

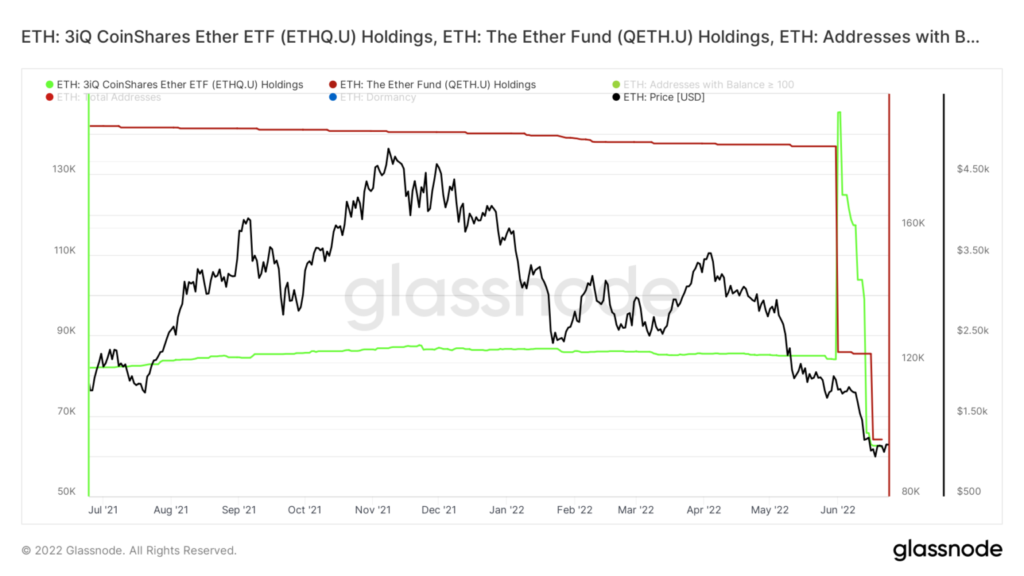

It turns out exchange-traded funds (ETFs) holding large amounts of ETH have been selling off their holdings. 3iQ CoinShares Ether ETF (ETHQ.U) and Ether Fund (QETH.U) holdings are among the top ETFs that invested heavily in ETH in the past. Their Glassnode metrics reveal that they offloaded a significant amount of ETH in June.

The 3IQ Coinshares ETF unloaded around 82,886 Bitcoin between June 1 and June 20. The ETF Ether Fund sold approximately 87,385 ETH between May 31 and June 20. Although these ETFs sold large amounts of ETH, each of them holds more ETH than the amount they sold.

Catching the next wave

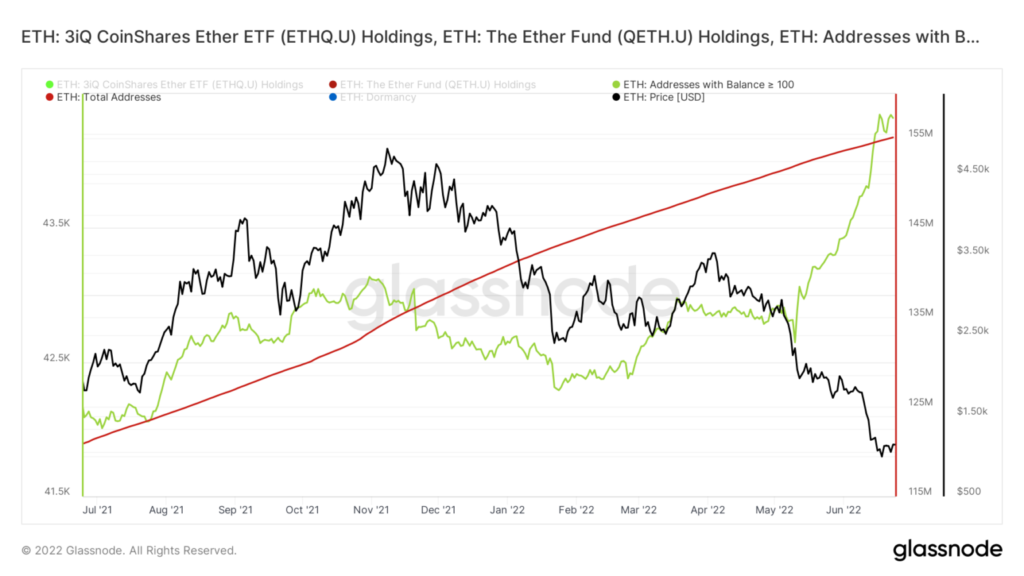

It is easily assumed that this means they will likely continue selling in the next few months given the amount they have left. However, the lower prices have been attracting heavy accumulation and strong growth in the number of users. ETH addresses holding more than 100 ETH have steadily increased in the last 12 months.

There were just over 42,000 addresses holding 100 ETH and above at the start of July 2021. This number increased to 44,343 addresses by July 23. ETH had just over 121.5 million addresses at the start of July last year. However, those addresses had increased to 155.1 million as of June 23.

The increase in ETH addresses and balance in addresses especially since mid-June confirms the strong accumulation near the $1,000 price level. ETH’s 30-day MVRV ratio confirms that some address balances that accumulated near the latest lows are already in profit.

The MVRV ratio lines up with ETH’s latest rally. This suggests that there is a strong buying wall near the $1,000 price level. However, the market is still full of uncertainty and ETFs still have a lot of firepower if they decide to sell more.