ARK Investment Management’s Yassine Elmandjra believes that Bitcoin may face another correction despite “stable” fundamentals

Yassine Elmandjra, an analyst at Cathie Wood’s ARK Investment Management, believes that risky assets such as Bitcoin could continue to suffer due to unfavorable macro conditions.

In a recent Twitter thread, Elmandjra has not ruled out that the Federal Reserve will continue hiking interest rates despite looming recession fears. In such a case, the price of the largest cryptocurrency is likely to decline further despite the fact that it recently recorded its worst quarter in more than a decade.

Net Unrealized Losses (NUPL), which fell 17% below the overall cost base, also show that Bitcoin could undergo another correction. According to Elmandjra, NUPL plunged about 25% near the lows of previous market cycles.

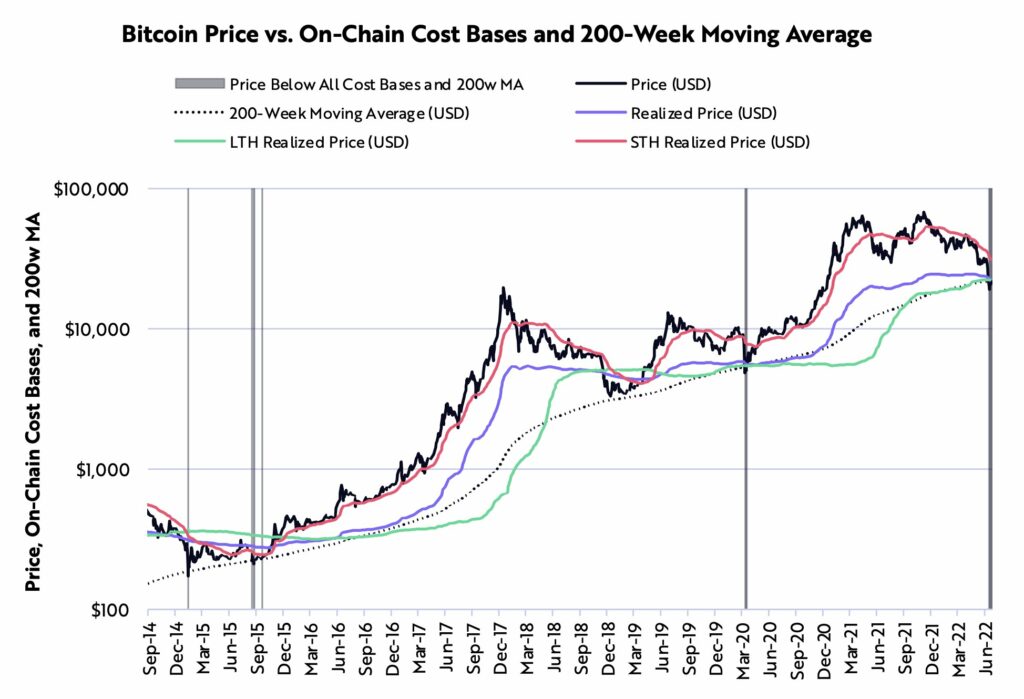

With that being said, Bitcoin has dipped below its 200-week moving average (WMA) on the short-and-long-term cost basis for the first time in its history. This suggests that the crypto king could be trading near another “generational bottom,” according to Elmandjra.

Key Bitcoin fundamentals such as network security, network usage, and holder behavior “appear stable” despite the massive shock to the industry from the collapse of high-profile players such as as Terra, Celsius and Three Arrows Capital.

Bitcoin’s “Puell Multiple,” one of the key indicators tied to miners, has dropped to its lowest level in three years. This might indicate that Bitcoin is likely bottoming out since the value of the newly issued coins is relatively low compared to average numbers.

Bitcoin currently sits at the $19,600 level on major spot exchanges after adding around 2.9% over the past month.