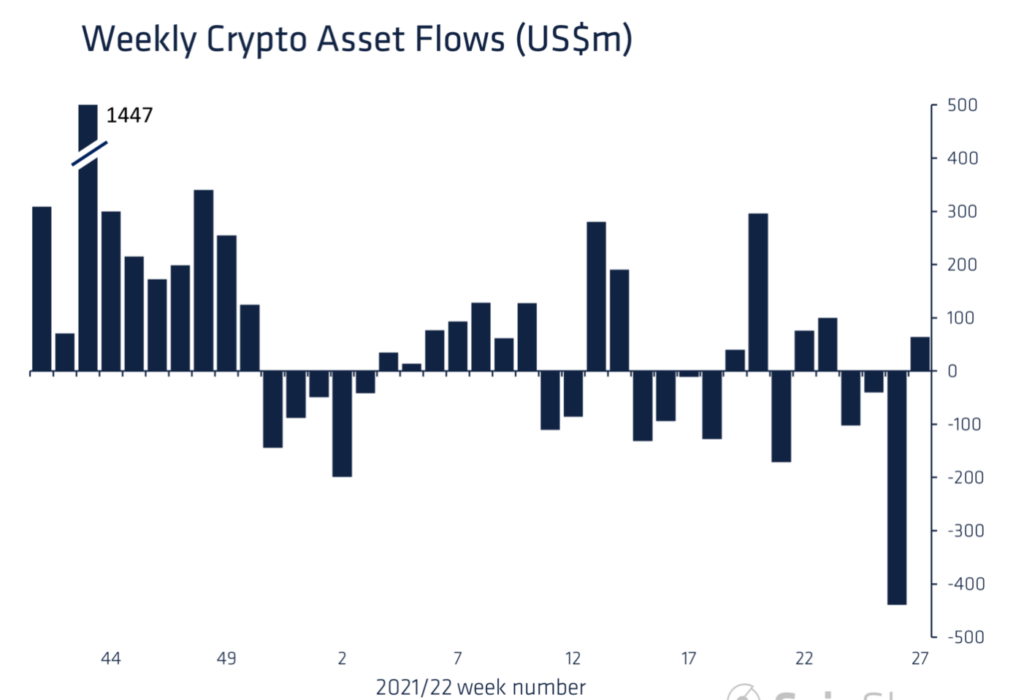

Halfway through 2022 and the cryptocurrency market has already witnessed a mass liquidation phase. The end of Q2, for instance, recorded $423 million worth of outflows for digital asset products. But now, this narrative witnessed significant changes as the market continues to regain its footing.

Headed in a different direction

Unlike the previous report, the latest edition of CoinShares’ weekly “Digital Asset Fund Flows” report has brought some relief to the market. According to the report, digital asset investment products saw inflows totaling $64 million last week between June 27 and July 1.

Geographically speaking, regions other than the U.S such as Brazil, Canada, Germany, and Switzerland saw small inflows totalling $20 million. According to the report, “this highlights investors are adding to long positions at current prices.”

Additionally, US-based investors saw inflows worth $46.2 million, with BTC short investment products in high demand. The inflows into short-Bitcoin are likely due to the first accessibility of short-BTC investment products. This means that ProShares launched the first-ever US-based Bitcoin Exchange-Traded Fund (ETF) short on June 22.

Here short-Bitcoin products are seeking to borrow Bitcoin to sell on the market before repurchasing it at a lower price.

Standing at the top

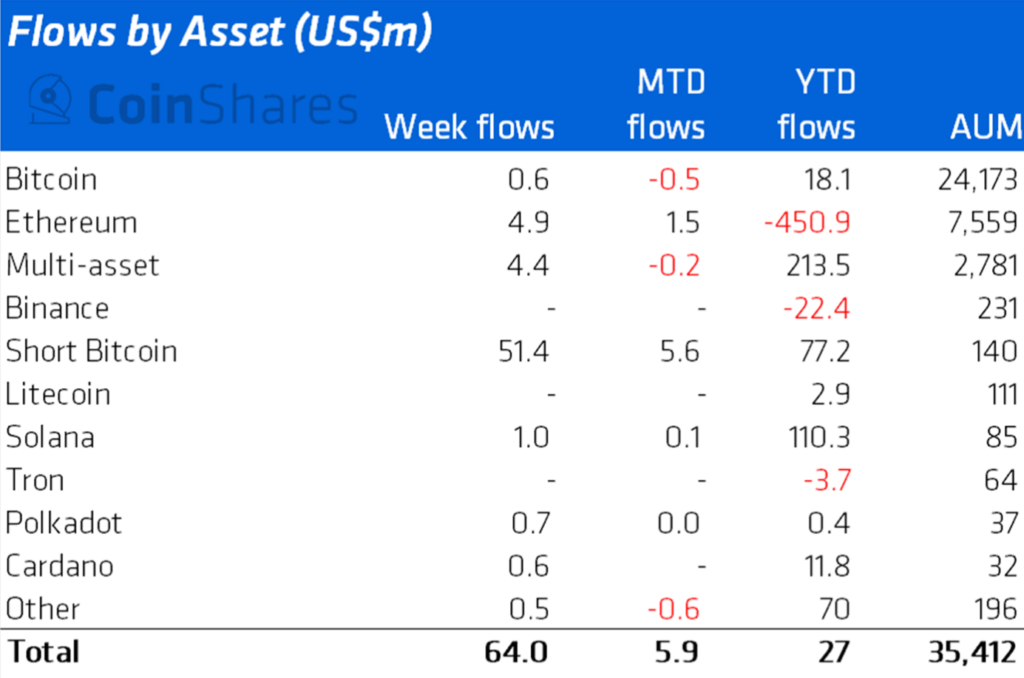

Moving on to specific coins, short bitcoin bullion products saw a record inflow of $51 million considering the launch of the product. While bitcoin [BTC] saw few inflows during the week, only totaling $0.6 million or $600,000.

Ethereum [ETH], the largest altcoin saw the second week of inflows totalling $5 million last week, breaking the 11-week spell of outflows. However, year-to-date outflows remain at a staggering $433 million.

Additional inflows into a range of other altcoins suggest investors have started to diversify again. Different products remain spread across multi-asset funds at $4.4 million. These products remain the least affected by “recent negative sentiment with minor releases in just two weeks of this year.”

Solana Solana [SOL], Polkadot [DOT], and Cardano [ADA] products posted minor inflows of $1 million, $700,000, and $600,000 respectively.

Overall, the current scenario has brought some much-needed relief to the cryptocurrency market from the previous outing. Nevertheless, the scenarios could change in no time.