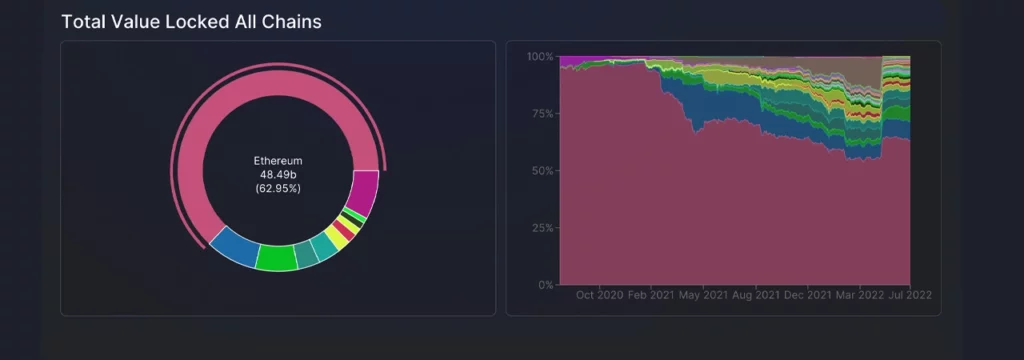

After tapping a 2022 low of $70 billion on June 19, the total value locked (TVL) in decentralized finance (defi) has increased by more than $7 billion. During the last seven days, the TVL in defi held within the Ethereum blockchain has increased by 4.47% as Ethereum’s TVL commands 62.92% dominance or $48.17 billion of today’s $77.11 billion. Meanwhile, Tron’s TVL skyrocketed this week, jumping 34.85% during the past seven days.

Last Week Tron’s TVL Jumps into Double Digits, Smart Contract Tokens Rise, Dex Apps Order Today’s Top Defi TVL Positions

Over the past week, six of the top ten challenge blockchains have seen their TVL stats increase by double digits. Ethereum jumped 4.47%, BSC jumped 7.02%, Tron jumped 34.85%, Avalanche recorded an increase of 2.81%, Solana rose 9.10% and Cronos rose 2.33%.

On Thursday, July 7, 2022, there’s approximately $77.11 billion locked in defi and that metric increased by 1.40% during the last 24 hours. The largest defi protocol TVL is Makerdao’s $7.54 billion or a dominance rating of around 9.78%.

Makerdao’s TVL dominance is followed by protocols such as Aave, WBTC, Curve, Uniswap, Lido, Convex Finance, Pancakeswap, Justlend and Compound respectively. Makerdao saw an increase of 1.56% last week, but the biggest gainer in the top 10 was Tron’s Justlend with a peak of 90.15% last week.

Tron’s Justlend has $2.79 billion locked and at the time of writing, USDD supply deposits get 12.83% annual percentage yield (APY) and the borrow APY is 21.76%.

In terms of losses, the Fantom blockchain saw 6.7% leave the channel’s TVL and Arbitrum was the biggest loser in the top ten list, with Arbitrum’s TVL down 11.01% this week.

Out of today’s $77.11 billion, 481 decentralized exchange (dex) applications command $24.67 billion total value locked, 155 defi lenders capture $17.55 billion, and 22 defi bridge applications currently have $11.31 billion locked.

In addition to the rise in defi TVL on various blockchains, the smart contract platform’s top tokens jumped 5.6% in the past 24 hours to $272 billion. Last week Ethereum (ETH) was up 11.3%, BNB jumped 10%, Cardano (ADA) was up 1.6%, solana (SOL) was up 13.3% and Polkadot was up by 2%.

The biggest smart contract token gainers this past week were counterparty (XCP) which jumped 25.3%, komodo (KMD) increased by 25%, and ubiq (UBQ) rose by 19.3% during the last seven days.

The TVLs of the combined inter-channel bridges have lost 60.4% in the last 30 days and Polygon’s bridge is the largest at $3.55 billion TVL. Polygon’s TVL bridge is followed by Arbitrum, Avalanche, Optimism, and Near Rainbow.

The top five digital assets leveraged on cross-chain bridge tech include USDC, WETH or ETH, USDT, WBTC, and DAI respectively.

This week, the worst TVL losses in decentralized finance came from protocols such as Piggbank DAO, Metavault DAO, Houses of Rome, Jade Protocol and Risk Harbor. The largest increases in the TVL protocol in challenge over the past seven days were recorded by Hermes Defi, Maple, Omni Protocol, OGX and Strategyx Finance.