Prominent analyst Jim Bianco believes that Bitcoin has a narrative problem

In a recent Twitter thread, prominent analyst Jim Bianco has opined that Bitcoin has a narrative problem after it failed as an inflation hedge.

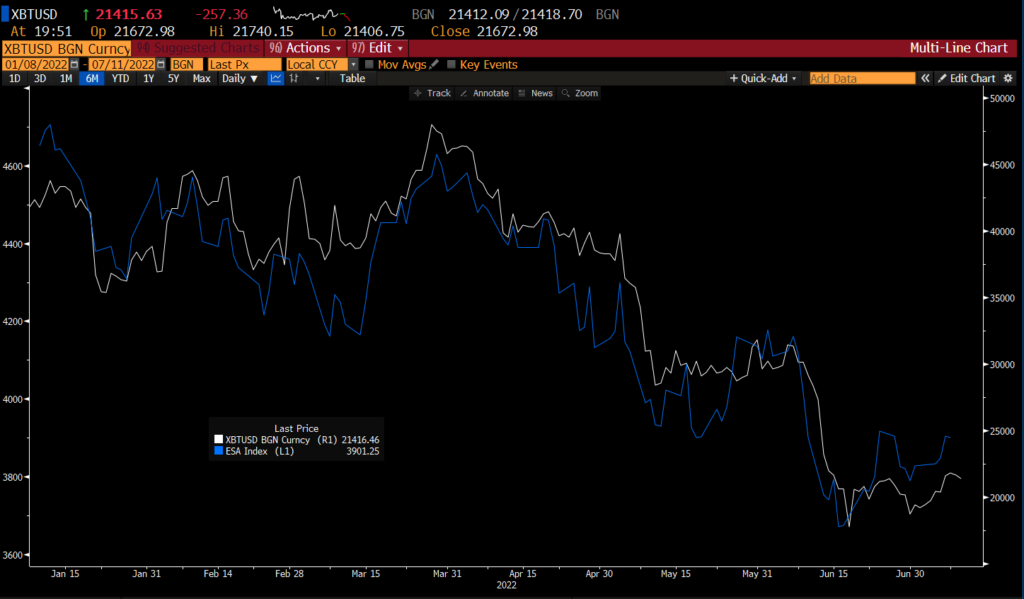

Bianco noted that Bitcoin has traded in line with S&P 500 futures over the past six months.

This high correlation continues to persist as cryptocurrencies continue to trade in tandem with stocks.

Bianco felt that Bitcoin actually amounts to being “a leveraged degen ES”.

“I’ve argued it should not be this way, by it is, and continues so,” the analyst wrote.

Although he has lamented the Federal Reserve’s ultra-easy monetary policy in the past, Bianco believes that Bitcoin is secretly hoping for more money printing, as risky assets tend to benefit from low interest rates and many forms of quantitative easing.

This is a major problem for Bitcoin’s long-term purpose, according to the analyst.

As reported by U.Today, Bitcoin recently recorded its worst quarter in over a decade. Meanwhile, the tech-heavy Nasdaq Composite, which tends to have a high level of correlation with cryptocurrencies, posted its worst quarter since 2008.

In 2022, Bitcoin failed to become a safe harbor during the market turmoil, which confirms the assumption that the world’s largest cryptocurrency is actually a risk-off asset.

In May, Bank of America, one of the major banking institutions in the United States, noted that Bitcoin was not a viable portfolio diversifier as it tends to work in tandem with stocks. Thus, the largest cryptocurrency cannot serve as a hedge against inflation.

Bitcoin is down more than 69% from its record high despite very high inflation.