Ethereum dumped below the $1700 demand zone in early June, and recovery was not yet in sight for the king of altcoins. The $1300 resistance was not yet breached, and the $1000 band of support has been defended over the past month.

Ethereum appeared to be forming a range, but it was likely following in Bitcoin’s footsteps. The king coin also developed a range, and it would take patience to navigate the markets without suffering many losses.

ETH- 12-Hour Chart

The range (yellow) ETH formed was between the $1285 and $1000 levels. The mid-point of the range lay at $1143, and it has been respected as both support and resistance in recent weeks. Therefore, the range pattern has added credibility.

Last month’s trading volume was higher than April or May individually, and trading volume has been somewhat flat in recent weeks. This indicated that ETH was trading at a place where long-term bulls and bears are interested. Also being a level of psychological importance, $1000 would be a critical area for Ethereum buyers to defend.

In the past few days, an advance to $1300 was rebuffed at $1280. Moreover, the price dipped below the mid-point of the range as well. This firmly hinted at a move toward the range lows.

Rationale

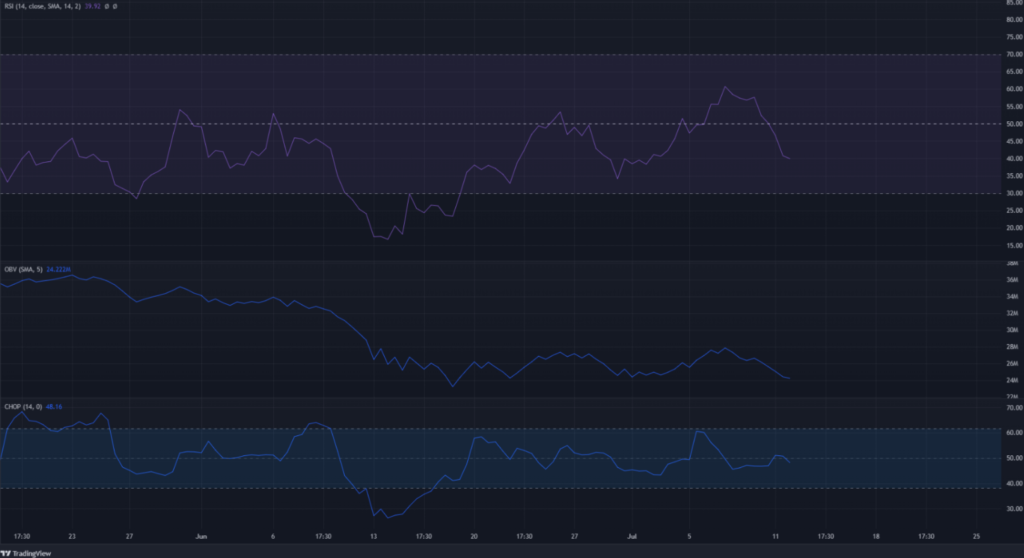

The RSI tried to break above 60 over the past few days, but couldn’t. The 12-hour RSI has been consistently below the neutral value of 50 since early April, indicating that the downtrend behind Ethereum has remained strong. The brief foray to 60 does not imply a trend reversal.

The OBV was also in a downtrend since April but has been quite flat over the past month. Once again, neither buyers nor sellers have had the upper hand in the past four weeks, further strengthening the idea of a range. The Choppiness Index stood at 48 to signal the lack of a strong trend.

Conclusion

The market structure remained bearish for Ethereum and would only turn bullish if the $1300 mark is breached. In the meantime, the $1,000 ask zone was a must-see zone for bulls. The $950-$1050 area could provide buying opportunities.