On-chain data reveals that bitcoin miners could be close to their capitulation after selling the most substantial chunk of BTC holdings for the past several months. As such, the asset’s price could be headed for another short-term dip to “well below” $20,000, CryptoQuant warned.

Bitcoin miners capitulate?

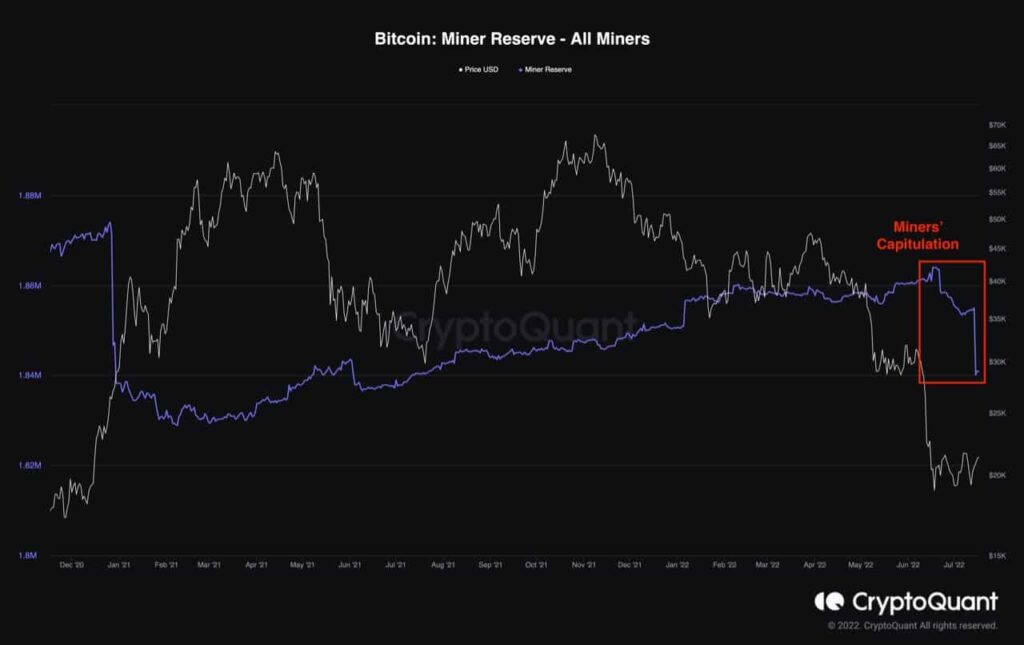

The company’s miner reserve chart shows the general behavior of BTC miners, and as the chart below shows, they have sold off a significant portion of their holdings over the past few weeks. This came after accumulating for more than a year after the previous such sale in early 2021.

However, there’s one substantial difference between the two sell-offs. Back in January 2021, miners were most likely taking profits as bitcoin soared to a new all-time high of roughly $30,000. Now, though, the landscape is different since the asset is down by about 70% since its latest peak in November 2021.

According to CryptoQuant, the latest correction, exacerbated in June, which turned out to be the asset’s worst trading month in a decade, “forced” miners to sell their BTC at current market prices to “minimize losses.” and reduce their overall risk”. ”

Concluding that miners are now in a distribution phase, the analytics resource warned that this growing selling pressure caused by the capitulation event “could push the price even lower in the short-term and bitcoin could drop well below the $20K mark in the near future.”

Miners suffering, hash rate drop

The market-wide retracement, perhaps fueled by the Terra collapse in May, the 3AC, Celsius, BlockFi fiasco in June, and overall economic turmoil, has pushed BTC south over the past few months, dragging falls below $20,000.

Miners, the backbone of the world’s largest cryptocurrency, had to sell some of their portions, as mentioned above. In fact, one report claimed that they disposed of all of their outputs in May, while several other miners did the same in June as well.

Yet that wasn’t enough for companies like Compass Mining, which had to lay off 15% of its workforce just weeks after two of its C-level executives left the company.

The mining landscape got another hit from weather conditions in different US states. Marathon Digital’s mining operations in Montana were hurt after a massive storm, while several miners based in Texas had to stop working due to rising temperatures.

Overall, the hash rate has decreased by 25% since its peak recorded a few weeks ago and has now fallen to 190 Ehash/s.