Ethereum [ETH] has seen its price action hike following the latest hype around the Merge. This is significant, especially since it always had a tentative timeline in the first place.

ETH gained 12.80% over a 24-hour period, topping $1,200 on CoinMarketCap. Additionally, the Total Locked Value (TVL) on various Challenge apps jumped 4.54% to $80 billion, according to data from DeFi Llama.

Delay on the cards per se?

Well, yes. However, here’s a fresh take on this – Jiang Zhuoer, a well-known Chinese miner and supporter of ETH, claimed that although Ethereum developers are expected to merge in September, it will generally be postponed and Dapp needs to be adapted. There is a high probability of a merge between November and December, he said finally.

Could this affect the price of ETH in the short term? It might or might not, but one attribute that has taken a hit is the windup problem. According to CoinGlass, in the past 24 hours, the liquidation amount was $346 million.

At press time, this number stood at $298.7M over the 24-hour mark. Now, ETH markets have rallied strongly off the back of a huge short squeeze in Futures markets. Over $98M in short Futures positions were liquidated in one hour, pushing ETH prices up by 12.5% on the charts.

Will this pump hold before traders sell their positions? Well, in order for that not to happen, ETH needs to increase its fundamentals. This, alas, was not the case at the time of writing.

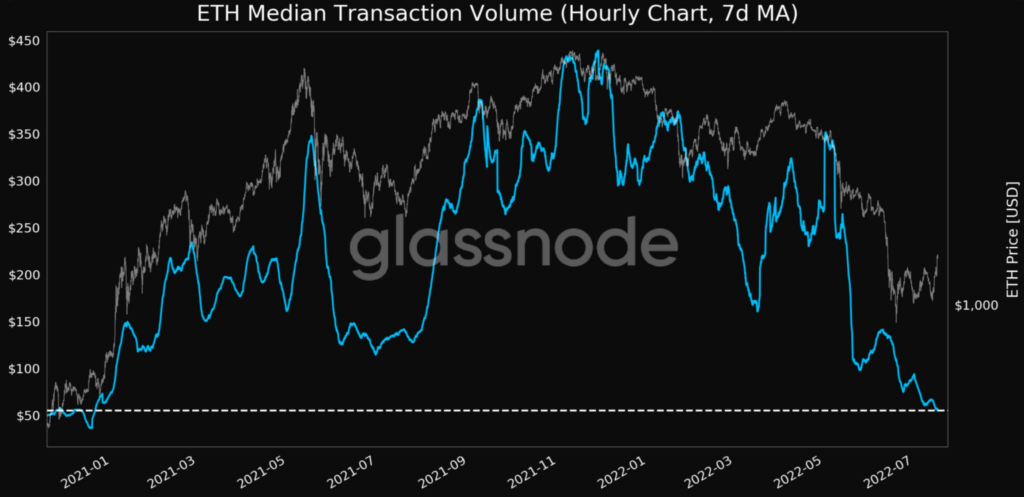

One of the best measures of on-chain activity is the number of transactions a blockchain processes over a given time period. Here, the number of user transactions for ETH suffered by more than 13%, as per CoinMarketCap. In addition to this, the Median Transaction Volume on Glassnode hit an 18-month low of $54.82.

This is discouraging to the ecosystem as it may suggest a stagnation in whale activity. Whale activity is often considered an important indicator of the general sentiment of a crypto-asset.

On the other hand…

… ETH’s staking activity seems to have gathered an impressive pace. Total Value in the ETH 2.0 Deposit Contract just reached a 1-month high of $17,888,663,888.92.

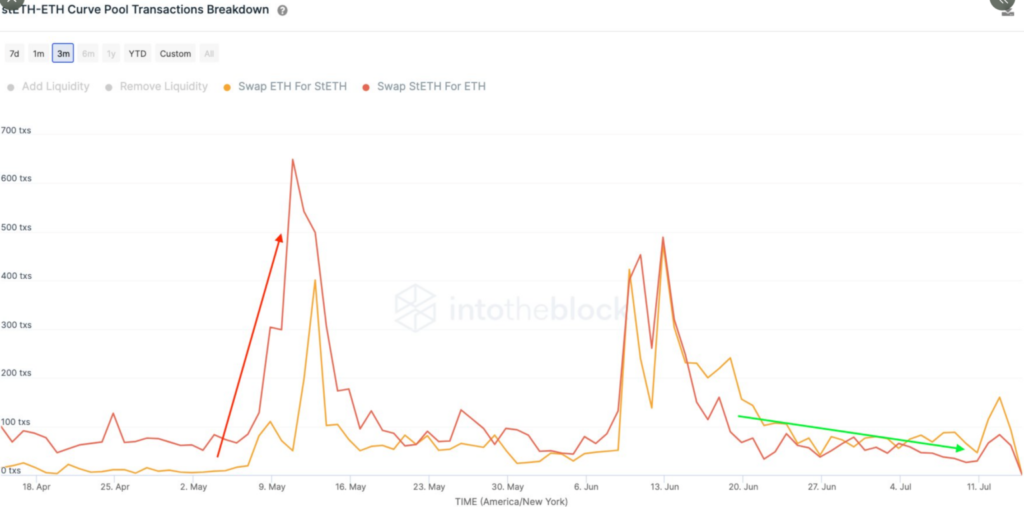

In fact, after the panic in May and June, more transactions are now trading ETH for stETH on Curve Finance than the reverse. That’s to say people buy STETH at a MAJOR discount.