Billions worth of BTC evaporate in one day

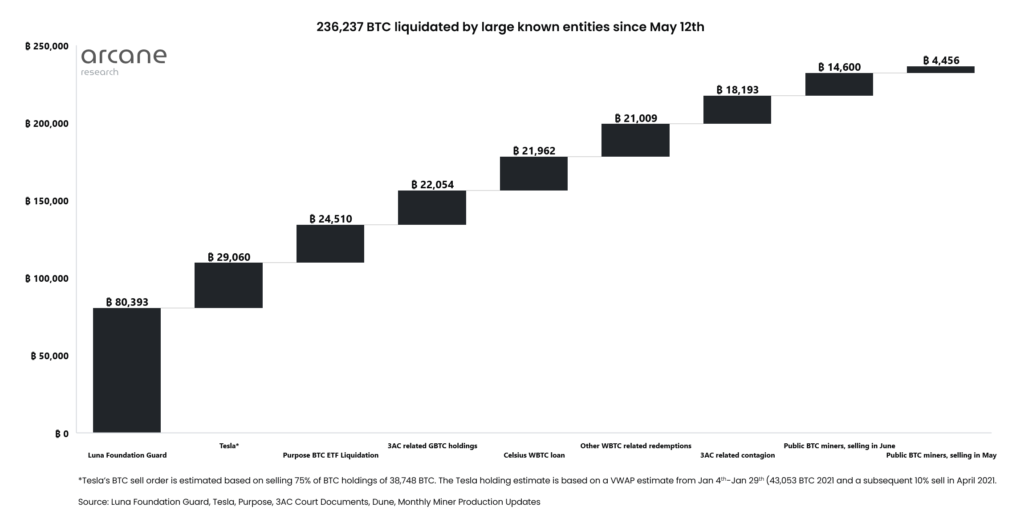

Cryptocurrency investment funds have lost almost $6 billion worth of Bitcoin following the massive series of liquidations on the cryptocurrency market back in the May-June period. The biggest loser in the market is, as expected, the Luna Foundation Guard.

The largest portion of the coins that were lost is tied to the series of large liquidations that appeared on the market after the price of the first cryptocurrency tumbled from $30,000 to $17,000.

Luna Foundation Guard has lost over 80,000 BTC, which is over $1.8 billion at press time. Second place in the ranking goes to Tesla as the company sold $900 million worth of BTC in May.

The notorious Three Arrows Capital was not the biggest loser on the market, despite being the most popular object of ridicule in the space since May.

The chart is closed by massive sell events staged by public miners who dumped around 19,000 Bitcoin, causing huge selling pressure in the market in June and fueling BTC’s disastrous run to $17,000.

Following Tesla’s earnings report, it become clear that the company’s massive sell-off made a huge contribution to Bitcoin’s rally to $17,000 as it caused another cascade of liquidations that hit Three Arrows Capital and pretty much liquidated a large portion of its positions, including Ethereum, which followed the first cryptocurrency’s path.

The start of summer 2022 could end up being one of the worst months for the whole market, which nearly collapsed to critical levels that would have affected the evolution of the whole industry in the long run. term.