Ethereum [ETH] surged by more than 60% in just 10 days, and spiked from just above $1,000 to roughly $1,650. This strong uptrend highlights the strong demand for ETH and it places the next major price target at $2,000 but will it recover above this level by the end of the month?

The strong rally came after the market confirmed that downside risk had subsided. Such a rapid recovery confirms that investors were eagerly waiting for the market to rally so they could ride the bulls. However, this is not the only reason why ETH has recorded such a strong rally.

The upcoming “Merge”

The Ethereum community has been preparing for Ethereum 2.0 transition for months now. The merge will take place soon and a major update will be released in August. Furthermore, market recovery means many investors may invest in ETH due to the fear of missing out on the lower prices. In fact, addresses with more than 100 ETH have been growing steadily in the last three months, adding to the bullish pressure.

Many believe that the merger will bring more value to the price of ETH and that the latest drop in recent months could be the last time it will be this low. The same metric indicates that there have been exits from these addresses following the recent rally.

ETH’s realized capitalization has steadily declined during the month. This confirms that most of the buyers paid a lower purchase price than ETH’s current market price. Many of the buyers in the last three months are thus in profit.

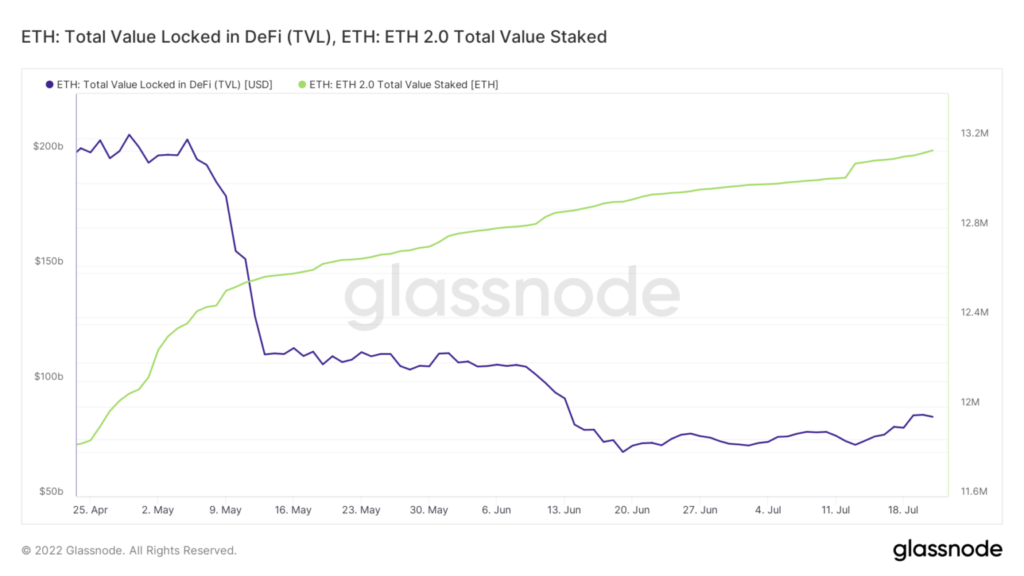

These metrics confirm that investors heavily accumulated ETH before the merger. The lack of a subsequent sell-off confirms that many are looking for medium to long-term gains. Many ETH holders also opted to stake their ETH before the merger. The outflows from DeFi staking facilities also highlight the magnitude of the impact of the merger on ETH movements.

The great exodus

ETH’s latest price movement has confirmed a certain level of demand. It makes little sense for holders to sell their ETH and forego more potential upside in the days leading up to the merge. In summary, the migration to ETH 2.0 is the currently greatest HODL incentive for ETH holders.

The current level of ETH is still relatively low and demand at current levels could contribute to a recovery above $2,000 before the end of July. If not, intense demand will likely show up in August. However, investors should always be wary of unexpected pullbacks which will provide opportunities for investors at lower prices.