Although bitcoin trades 25% higher than its multi-year bottom tapped in June at $17,500, CryptoQuant suggested that the asset could face upcoming price drops. This is because of the Bitcoin Exchange Whale Ratio, which has gone into an overheated state.

Bitcoin heading south again?

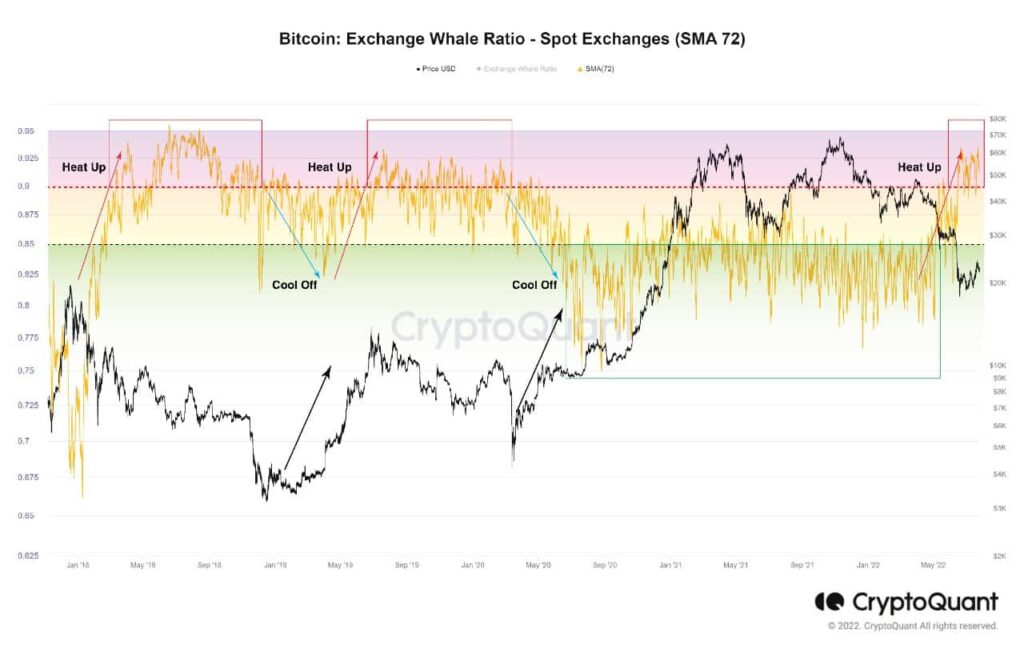

The metric tracks and displays the relative size of the top 10 inbound transactions compared to total inflows on crypto exchanges. In bull markets, as was certainly the case through the end of 2021, the ratio is typically below 85%.

In contrast, though, it’s usually well above that percentage when the bears are in control of the market, or there’s what CryptoQuant describes – a “fake bull (market) for a mass-dumping.”

The analysis resource’s latest report on the matter showed that the whales’ exchange ratio jumped above 0.925, which is a multi-year high. The last time it was this high was in early 2020, shortly before bitcoin cooled off by falling below $4,000 during the COVID-19 crisis.

Since then, the metric has remained mostly below or around 0.85, which coincided with the massive bull run that resulted in BTC tapping an all-time high of $69,000 last November.

It broke above the 0.85 level in the second quarter of 2022, which turned out to be the asset’s worst quarter in a decade. Since it remained in this danger zone, CryptoQuant concluded that BTC could be primed for more price retracements as “there are no apparent signs of cooling.”

BTC Price Update

As mentioned above, BTC peaked in November but has been in a state of freefall ever since. The situation worsened in June this year when bitcoin plummeted from over $30,000 to its lowest price position since December 2020 of $17,500 in just days.

The following weeks saw some relief as the cryptocurrency recovered to the coveted $20,000 level. Last week another surge in prices was seen, this time the asset reached a 40-day high of over $24,000.

However, it couldn’t continue upwards and dipped by $2,000 on news that Elon Musk’s Tesla had sold 85% of its BTC holdings during Q2. As of now, it still trades around $22,000, but it would be intriguing to follow whether it will slip again as the Whales Exchange Ratio suggests.