The news of the Ethereum Merge pumped up optimism on the network. However, ETH, at press time, was consolidating above $1600 as the Merge craze started easing coming into the weekend.

In the current relief rally, ETH has outperformed the King’s Coin by gaining 19.07% over the past seven days. Now the question remains: will King be able to maintain the momentum in Merge’s September release?

ETH’s current performance can answer

This week has been a resurgence for Ethereum as it continues to steer through the bear market.

Investors saw a strong rally above $1,600 after being exposed to dramatic lows below $1,000 in June. But the release date of Merge around September surely had an impact on the trajectory of the altcoin.

The transition is expected to be a fruitful addition to the network. The Merge would lead to higher profitability across the Ethereum network in the coming months as per an IntoTheBlock analysis.

As inflation continues to weigh on the global economy, Ethereum is poised to become the biggest deflationary currency.

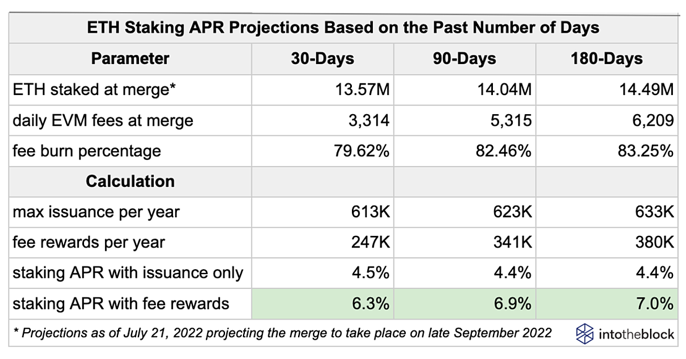

Ether issuance is expected to drop by 90% after the Merge. In the wake of the EIP-1559 release last year, 80%- 85% of transaction fees are burnt.

This will likely result in more ETH being burned than issued.

Currently, staking ETH produces yields at 3.9% which is expected to surge to 6% to 7%.

Higher staking returns will in turn result in more ETH being staked. This will lead to greater security as it would become more expensive to acquire 51% of the staked ETH.

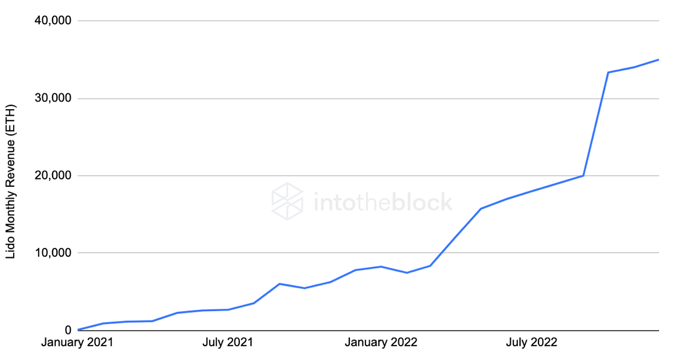

Increasing yields will mean higher profitability for staking providers such as Lido.

Those who stake ETH will not be able to withdraw funds until 6-12 months after the merger. ETH staked on Lido will only grow in this scenario.

Now, if macro conditions continue to worsen, the situation could change completely for investors. Nevertheless, traders’ optimism remains high on Ethereum as they carry a lot of expectations ahead of ETH’s Merge release.