Following the broader market cues, the largest altcoin Ethereum had a good rally in July. However, the scenario seems to be changing for ETH now.

With the upcoming merger, Ethereum network investors are excited. Ethereum has passed all speculation, FUD with Merge support is a matter of contemplation.

But one wonders if investors are bullish on ETH ahead of the much-anticipated transition from PoW to PoS consensus mechanism?

Hiccups, errors and more

In the past 24 hours, over 57,000 traders have been liquidated in the crypto market. This led to a total of $150 million in liquidated assets over the past day. The biggest of these was the Ethereum liquidations.

As ETH traders await the September proof-of-stake consensus mechanism transition, there are still hints of uncertainty- such as negative sentiment and Ethereum’s percentage of coins sitting on exchanges as highlighted in Santiment’s tweet below.

Indeed, the growing supply of ETH on exchanges is the main concern at the moment. Even the much-talked-about price spike in July didn’t quite satisfy investors/traders.

Ergo, they kept their coins in the place which provides ease to execute future sell-offs.

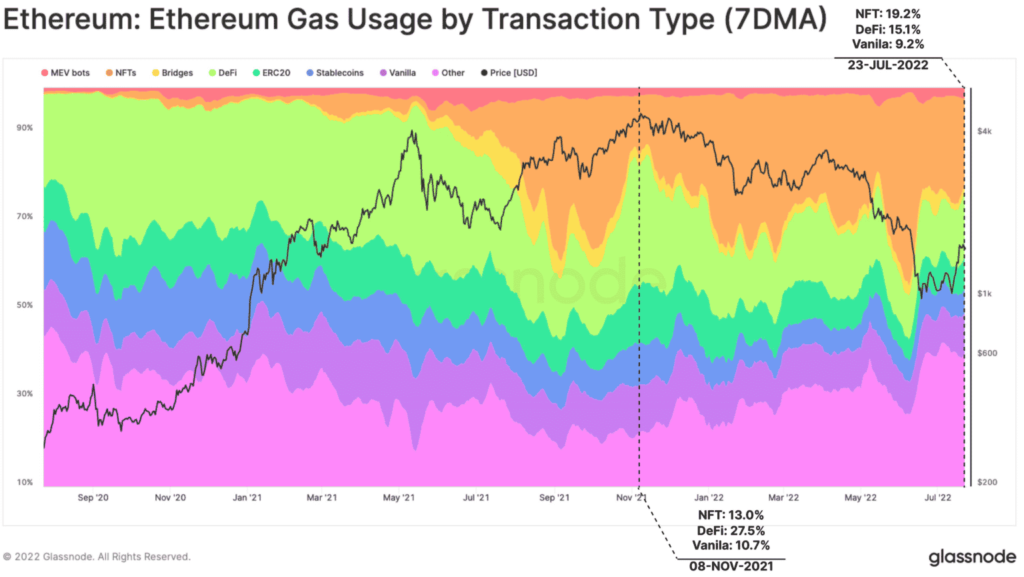

Another worrying indicator was the DeFi domain. The dominance of DeFi applications fell from 27.5% to 15.1%.

Glassnode, the analytical platform shared this scenario in the graph below.

To put this into perspective, Ethereum’s market share on DeFi TVL was 100% at the start of 2021. However, this figure dropped by more than 65% towards the end of the same year. Well, 2022 hasn’t favored bulls much.

Only 6% chances of sunshine

Having said that, the NFT arena did highlight a welcome sign for ETH enthusiasts. ETH’s relative gas consumption dominance by NFT activities grew by 6.2% since November. Thus, showing a continued market preference for NFT transactions.

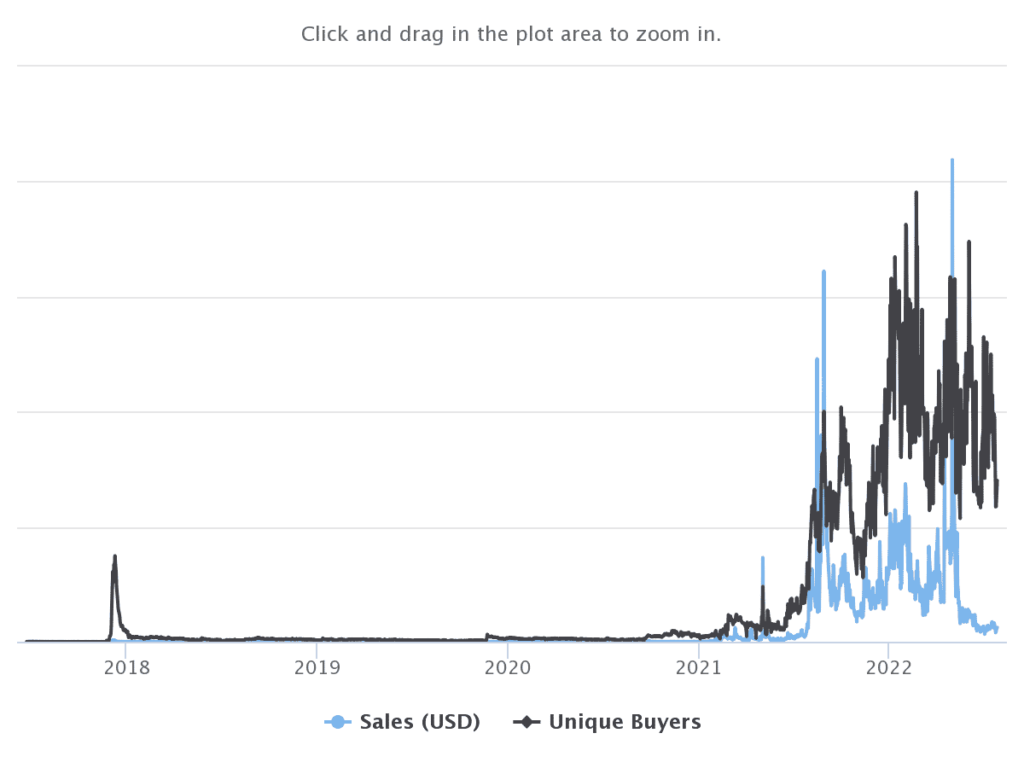

Additionally, according to data from CryptoSlam, the average sale price of an Ethereum NFT dropped from $2,463 in May to just $440 at press time, a drop of 71%. So, as the crypto bear market continues, NFTs are being bought for less.

The aforementioned developments did indeed affect ETH’s price. At the time of writing, ETH suffered a fresh 8% correction as it traded around the $1.4k mark. Even ETH holders (0.1+ coins) reached an all-time low of 6,892,910.