The king of altcoins has been struggling to gain its momentum and get back to its feet. In fact, the Ethereum [ETH] community is beginning to react to the Fed meeting and gross domestic product (GDP) release.

Recent on-chain data suggests tensions are running high as the crypto relief rally loses momentum. Traders can now see red lights with high FUD sentiment in the crowd.

Earlier, Ethereum investors were solely divisive over the meteoric rise of ETH. It is still an anomaly for a major currency, such as ETH to get a dramatic rise of 58% in well over three weeks.

Despite the hyper-inflated returns, traders had a negative bias and were confident that it would lose momentum. Then, from the high of $1,640, ETH crashed to $1,400.

‘Wait’ is the word

Well, to assess traders’ enthusiasm, one can have a look at the ‘Average Fees’ for transactions metric.

In the charts, it’s pretty obvious that the competition for block space has become less intense over time.

This can mean that market participants aren’t feeling the fear of missing out on low fees. It indicates diminishing courage in the Ethereum community.

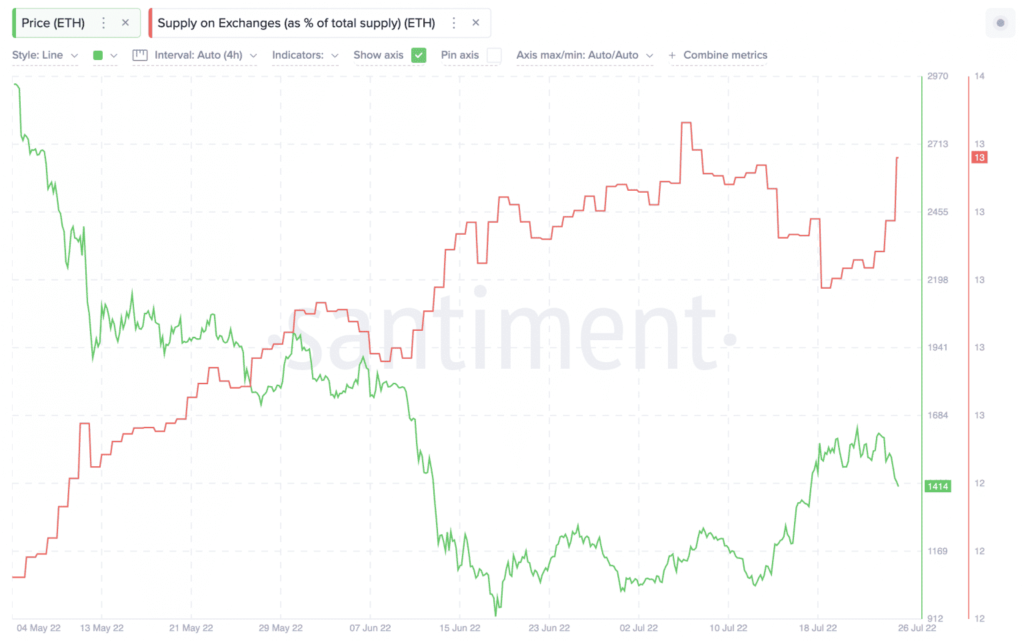

Another important metric is the supply of Ethereum on exchanges. The global supply on exchanges has been increasing at clock speed since the beginning of May 2022.

One interesting observation is that during the 58% rally, there was no change in the momentum. This means that investors have been unsure about ETH’s price rise and expected it to fall.

Recently, a sharp increase of 500,000 ETH (0.5% of total supply) was added to exchanges, suggesting a further loss of trader confidence in Ethereum.

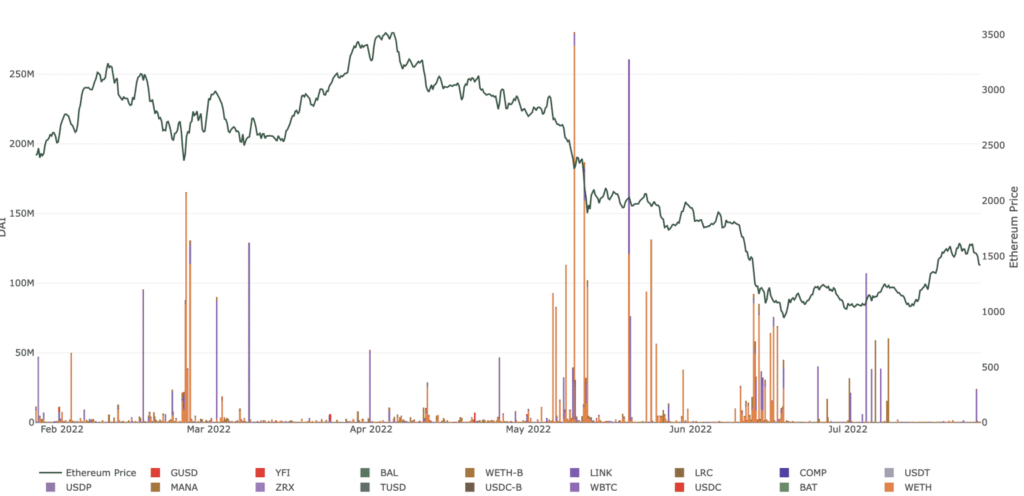

On the other hand, to get clarity about the general market picture, one can consider the metric of MakerDAO debt repaid.

Data collected by Santiment suggests that no new debt has been created in the past three weeks while some repayments have taken place as of July 27.

This further shows that market participants are cautious and are preferring to reduce their exposure.

With a bearish sentiment in the community as well as the tough market conditions evident, ETH should sink in the near term.

A price rebound may be possible around the release of the Merge. However, in present circumstances, this seems unlikely with the global economy battling inflation.