Bitcoin has been slowing down on its bullish momentum after crossing the barrier at $22,000 and $23,000. The cryptocurrency still holds some of its gains from last week but might be poised for a re-test of lower levels.

At the time of writing, BTC price is trading at $22,900 with a 2% loss over the past 24 hours and an 8% gain over the past week.

This Bitcoin Bear Market Might Not Be Like 2020

Crypto market participants seem to be in pursuit of a quick and persistent uptrend, like the one seen in 2020. At that time, BTC’s price drop to a low of $3,000 and then began an ascend to its current all-time highs.

However, trading firm QCP Capital believes that the price of bitcoin and other major cryptocurrencies may see more sideways movement and downside pressure before reclaiming lost territory. This price action could be like a 2018 bear market.

The firm believes BTC’s price will benefit during Q3, 2022. During this period, the cryptocurrency might attempt to reclaim higher levels, but with a potential to break above critical resistance areas capped by increased selling pressure from the Bitcoin mining sector and crypto companies suffering due to the bearish trend.

BTC price action may continue to act with “snappy moves” on an uncertain basis, with an alternate narrative between bullish and bearish forming a significant resistance at $28,700 and a downside support at $10,000 .

The latter matches the 85% crash that BTC’s price experienced during the 2018 bear market.

Crypto Recovery Will Be Slow, But Shows Long-term Bullish Signs

When the price of bitcoin hit its previous all-time high of $20,000 in 2017, the crypto market followed with a massive rally. By 2018, the region entered a multi-year bear market in which the major cryptocurrencies lost over 80% of their price, reducing trading liquidity with them.

QCP Capital believes the sector has entered a new age of more maturity and resilience. The current downside selling pressure has seen high liquidity in a robust environment with less volatility across large cryptocurrencies.

Furthermore, institutional interest in Bitcoin and Ethereum has remained consistent despite declining price action. In fact, QCP records growth in “both trade and investment” from these entities.

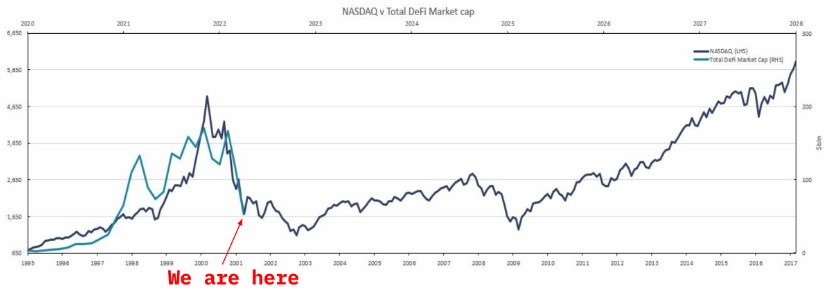

In the long term, this resilience in the face of high inflation and a hawkish Federal Reserve will translate into a massive rally. The trading firm compared the potential growth of the crypto ecosystem, for the decentralized finance sector, with the Nasdaq 100.

As seen below, the crypto sector is following the early years of the index and may lower before global adoption in the coming years. Which suggests over the next decade:

(…) that the future will be a crypto-dominated one. The same way every company in the world today is, to some degree, an internet company. We believe in a 5-10 years from now, every company will be, in some way, a crypto company.