Over the last few weeks, Bitcoin [BTC] has maintained a solid position over shorts. In fact, this strength was enough to send BTC to $24,000 and keep it above $20,000 for most of July.

However, things may take a new turn. Cryptoquant analyst Ghodducifer believes the price of BTC may be Shortage Due to the selling actions of short-term investors. According to a blog post on August 6, the analyst noted a downside potential. he said,

“We see a negative divergence in the RSI and MACD oscillators. These could be a pre-signal of the possibility of wedge breakdown”

So, is there a correlation between BTC’s ongoing momentum and analyst suggestions?

Projections in alignment

Well, based on the BTC/USDT chart, the analyst could be right. At press time, the Moving Average Convergence Divergence (MACD) underlined that sellers were in control with the shorts’ strength (orange) slightly above the longs (blue).

The implications of this momentum indicator also seem to agree with their claim of a negative divergence.

The Relative Strength Index (RSI) can also be seen towing a downward momentum and consolidating between the 50-level and below it. With the indicator struggling to rise above, it could as well mean that the sellers are taking out profits or counting their losses.

Even the on-balance-volume (OBV) was moving southwards. Simply put, BTC is struggling to cope with selling pressure at the time of writing.

What is the on-chain outlook

Over the last 24 hours, BTC has been moving between the $22,500 and $23,500 price levels. However, bears seem to be intensifying their efforts for a major drawdown.

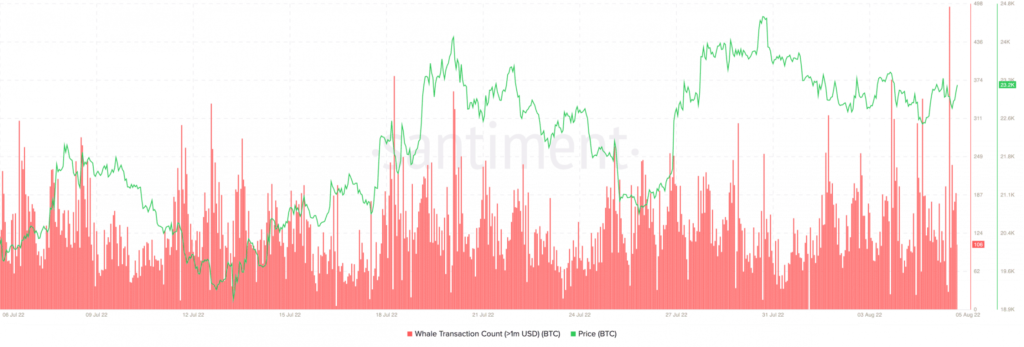

In fact, at press time, sentiment data showed that a Growth BTC whales under selling pressure. This caused BTC to lose momentum on the charts.

Also, further pressure could drive BTC to more volatility at the expense of short-term bulls. There are indications of a market shift if sellers sustain the momentum going into the weekend. Possible investor profit-taking could also be on the rise after a hike in accumulation and trading volume during the week.

With all this happening, there may be a need to sharply increase the activities of buyers to counter the current market situation. Having said that, BTC has been in a neutral position over the past 24 hours.

At press time, the change on the charts was almost negligible as per CoinMarketCap, with the crypto valued at $23,199. This confusion about an uptick or a fall may confirm that the selling pressure on BTC has increased.