Bitcoin, the largest cryptocurrency holds on to two main catalysts for support. Mainly the mining activity and transactional requirements via the Lightning network. But it seems like the former took a major hit while the latter continues to aid the network reach new heights.

here is the analogy

Bitcoin miners have experienced a trap in the crypto market due to the recent crypto crash. Now with the bitcoin price crashing into 2022, underwater miners are forced to sell in a downtrend in the market.

One should know, that Bitcoin mining is energy-intensive and stable load that can be rapidly adjusted up or down with extreme precision at no extra cost.

These factors make it an unmatched option for stabilizing the electricity grid through demand response. Well, in this case- things have turned south, at least for BTC enthusiasts and not for the company in the limelight.

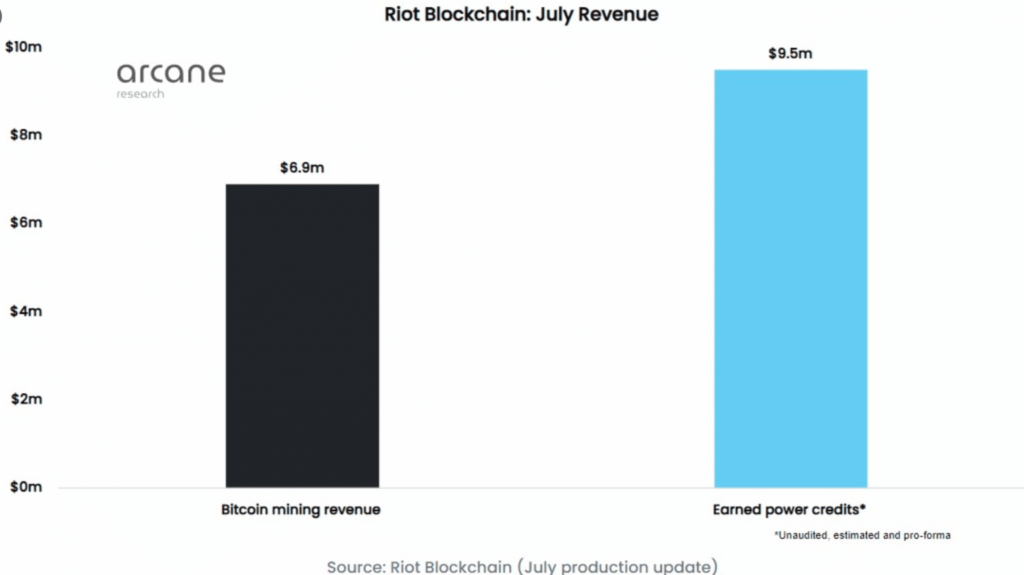

In July, a Texas Bitcoin miner earned more turning off machines than mining Bitcoin.

Sounds weird doesn’t it? But it’s actually true.

Riot Blockchain generated $9.5 million worth of power credits in July, significantly more than their Bitcoin production this month of 318 BTC, worth $6.9 million.

Here’s How It Makes Sense—To Earn These Power Credits, Riot deduction In July, earnings fell to 8,468 MW, $1,122 per MW. according to Tweet,

“If they had directed this energy to mining bitcoin instead, they would have earned only about $140 per MWh, making them heavily financially incentivized to curtail production.”

But the question is whether the market recovery is at the forefront, should miners be playing the waiting game?

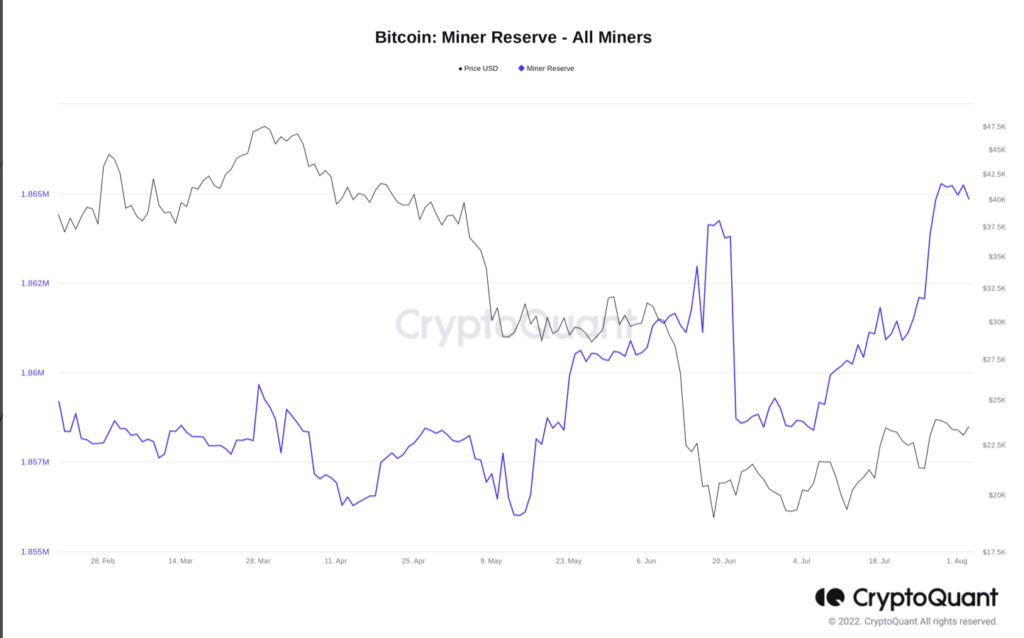

In the latest sign of miners recovering from recent price weakness, the amount of BTC in their wallets has hit a fresh multi-year high.

Between July 6, when reserves hit local lows, and the July 29 peak, miners’ wallet balances increased by 0.37%, or 6,885 BTC.

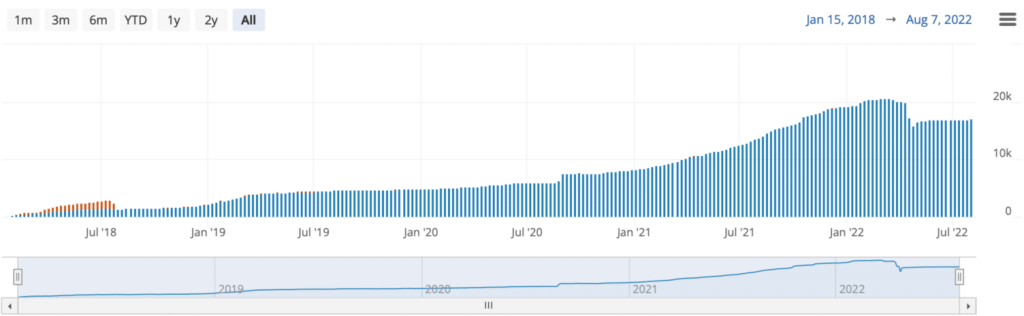

CryptoQuant’s contributor and analyst Jan Wuestenfeld shared this development in a graphical analysis above.

Greener Patch Here

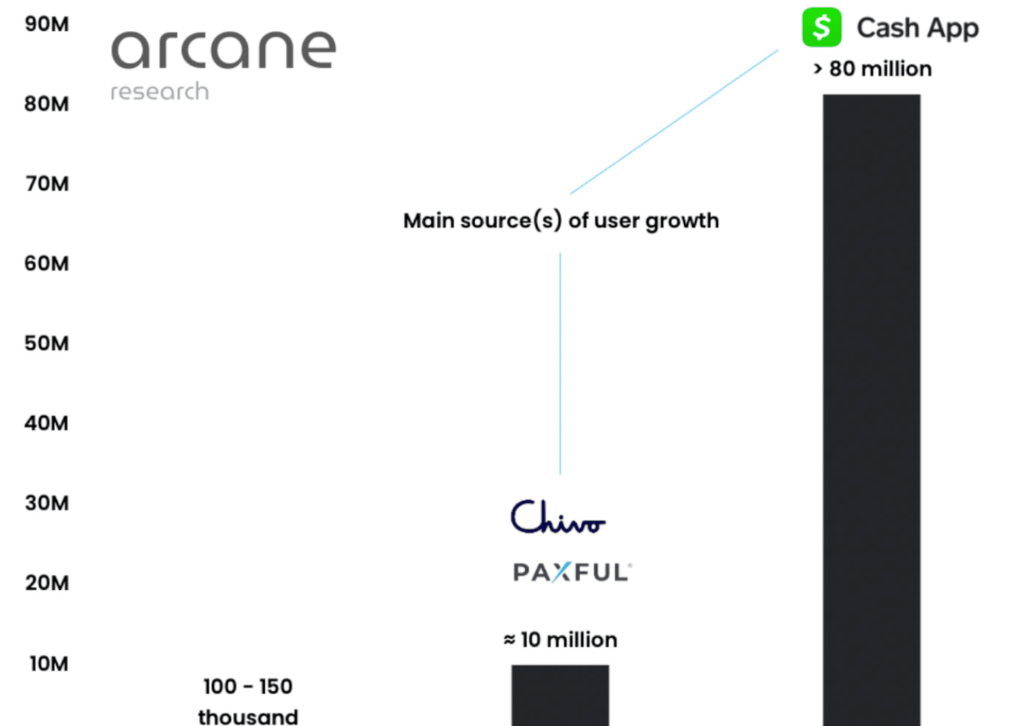

Moving on to the bullish narrative, BTC’s famous Scalping Transactional System (LN) has demonstrated growth. As reported by Arcane Research, the flagship network posted incredible growth, as seen by Block’s Cash app that integrated the Lightning Network. Thus, allowing its US users to send bitcoins for free to anyone around the world.

The graph below showcased the number of users with access to Lightning payments between August 2021 and March 2022.

In terms of growth, the user base went from a mere 100,000 users to over 80 million potential users in a matter of months. It is still flourishing.

In fact, the number of nodes, according to Bitcoin Visuals surpassed the 17k mark. Ergo, pointing toward increased user adoption.