Yesterday, the majority of the cryptocurrencies were flashing red as Bitcoin price lost its hold over the $23,000 mark. However, today, the flagship currency is not only trading above the $23k area but has also reclaimed the $24,000 level.

At the time of reporting, bitcoin is trading at $24,595 after a 2.65% increase over the past 24 hours.

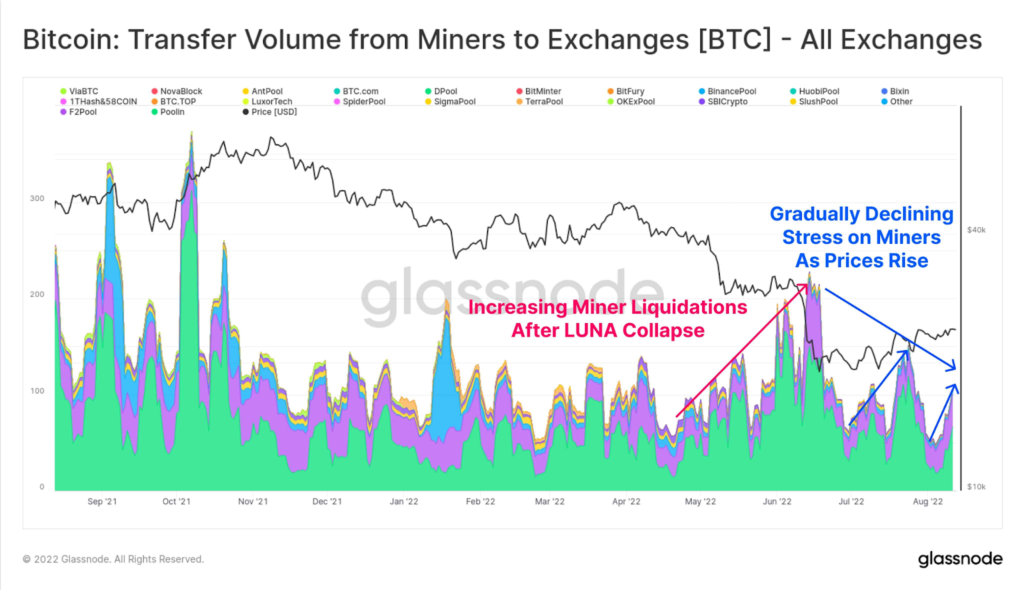

Meanwhile, the Bitcoin miners have been booking profits alongside the increasing price in order to cover their operational costs. A Glassnode survey pointed out that the Bitcoin hash-ribbons are in the opposite direction, indicating increased stress within the mining sector.

However, the analytic firm also claims that the 30-day moving average is getting some stability now which says that the financial situation is improving.

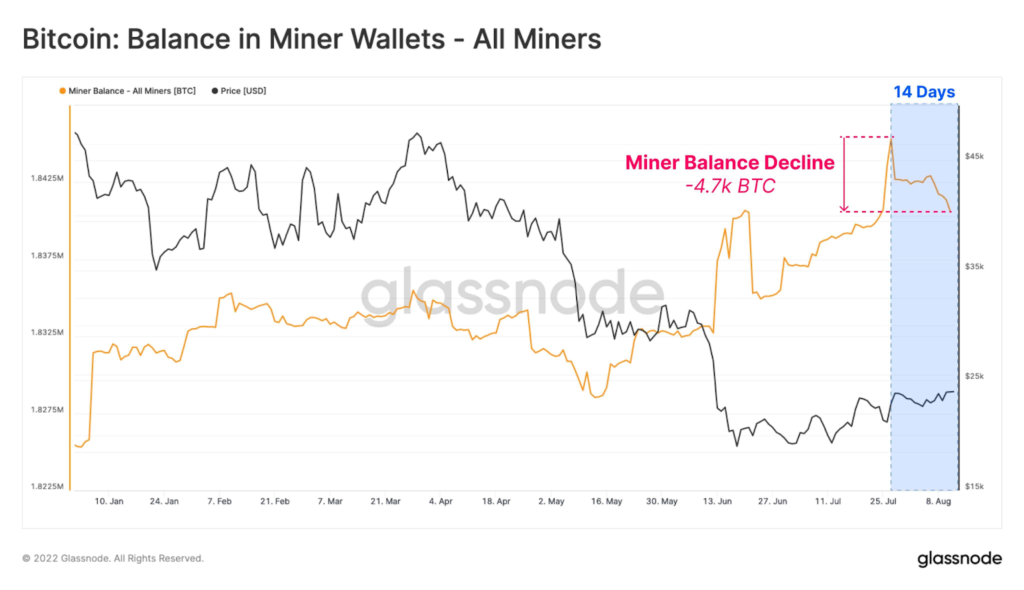

For the last two weeks, the Bitcoin price was hovering between the $22,000 and $23,000 range and during this time, there was a decrease in the Bitcoin miner balance. The reason for such a scenario was due to miners’ desire for more liquidity. Hence, this kind of sell action directly impacts the Bitcoin price rally.

Will Bitcoin Miner Stress Affect the Price of Bitcoin?

Subsequently, the Glassnode report points to bitcoin miner stress. It noted that in June, when the price of bitcoin was at a low of $20,000, miners were under stress.

However, in recent days the miner distribution over the exchanges has plunged, indicating that as the stress around the Crypto space remains, there could be some worse days ahead.

Conversely, if Bitcoin manages to trade above the $25,000 level, the community could soon see BTC at $30,000.