In 32 days, Ethereum is expected to upgrade from a proof-of-work (PoW) consensus algorithm to a proof-of-stake (PoS) system after the network used PoW for seven years. While the testnets have implemented the new rules, most people envision a relatively smooth mainnet transition. However, another chain is expected to fork away from the Ethereum branch and since August 8, the proposed fork called ETHW has gained market value in a few IOU markets. Despite the value gathered, the potential token lost more than half of its USD value in less than six days’ time.

While ETHW Captured Value, Proposed Ethereum Fork Token Price Dropped Over 53%

Ever since bitcoin miner Chandler Guo started talking about a new proof-of-work (PoW) version of Ethereum, following the on-chain transition to proof-of-stake (PoS), the idea has gained some traction. have done it. Crypto asset exchange Poloniex revealed the launch of ETHW markets and a new website called ethereumpow.org.

Statistics from coinmarketcap.com indicate that MEXC, Digifinex, Gate.io, and Poloniex list ETHW IOU markets. But the ETHW site also claims to have connections with a number of “communities, exchanges, miners and individuals [that] have worked together to make ETHW possible.” Twitter vertical trends show that the ETHW fork is controversial among die-hard Ethereum supporters and Ethereum Classic supporters have chimed in as well.

The website shows connections via ETHW exchange listings, and alleged mining supporters such as Binance, FTX, Antpool, Poolin, Coincheck, Huobi, Hiveon, Flexpool.io, 2miners.com, F2pool and Bitfly. ETHW has been listed on exchanges offering IOU markets for about six days now.

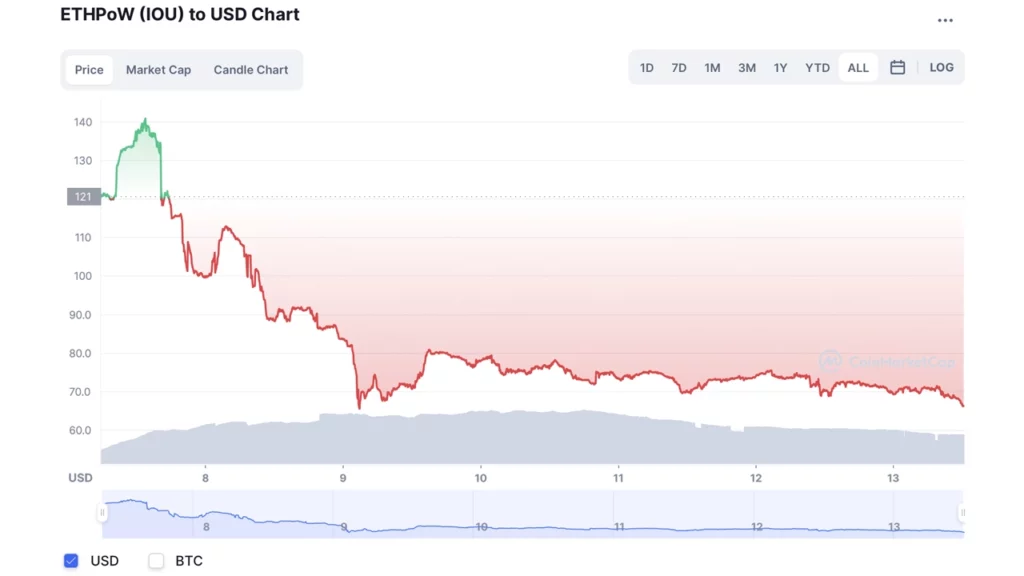

Ethereumpow.org also claims it has a bridge partner and advertises Bridgetech’s logo on the site. When markets officially launched and ETHW came out the gate, the value jumped to an all-time high of around $141.36 per unit.

Since then, ETHW has decreased in value by 53% and compared to the current value of ETH, ETHW represents 3.2% at the current market cap. ETHW tapped to an all-time low on August 10, 2022, reaching $65.17 per coin and is up 1.9% at the time of writing, trading for around $66.10 per unit.

ETHW’s value is more comparable to ethereum classic’s (ETC) current value, which is around $43.86 per unit at the time of writing. That means ETHW is $23 higher in USD value today than ETC’s current value. Yet many crypto supporters have discussed how ETC was created for ideological reasons while ETHW is being called a “money grab.”

So far, there has been no significant increase in Ethereum Classic’s hashrate

Most of the mining pools mentioned on Ethereumpow.org already mine Ethereum Classic (ETC). For example, 2miners.com is the second largest ETC mining pool, dedicating approximately six terahashes per second (TH/s) to ETC’s PoW network.

As far as the ETHW fork, if even one of the aforementioned mining pools that allegedly support the chain start mining it, ETHW will become a reality. Presently, dozens of ethereum mining pools are seemingly mining ETH to the very end, as the crypto asset’s rise has made it quite valuable to do so.

The hash rate of ETH is much larger than that of ETC and so far, there has been no meaningful increase in the hashrate of ETC, except for the initial spike on July 28, 2022. Ethereum is currently one of the most profitable crypto networks for me, as is the new Antminer E9 from Bitmain. , 2.4 GHz per second (GH/s) or 0.0024 TH/s, can yield an estimated profit of about $63.43 per day.