The Ethereum options market is heating up ahead of the much-awaited merge upgrade

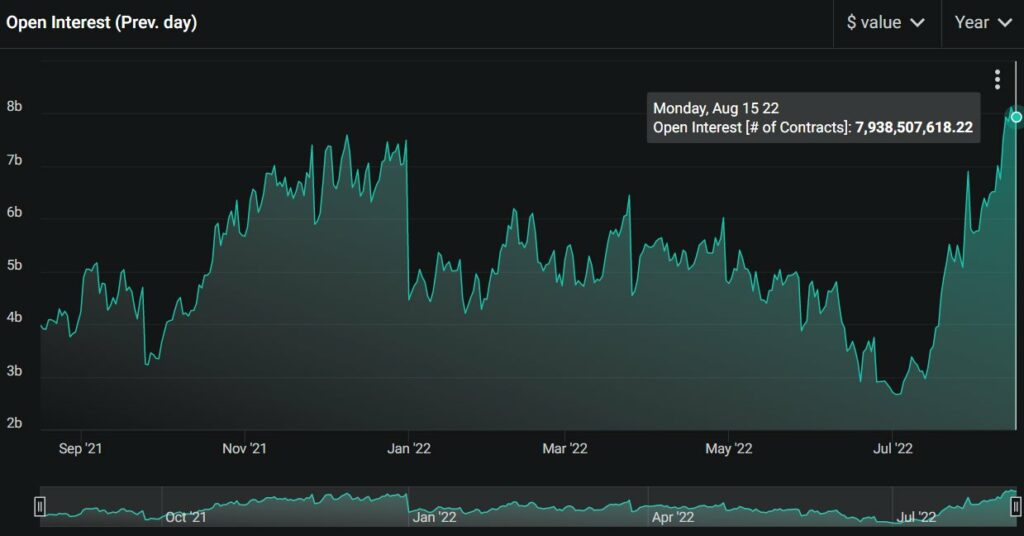

According to data provided by Coinglass, Ethereum Options Open Interest recently crossed the $8 billion milestone. For comparison, bitcoin options open interest currently stands at $5.3 billion.

The widely followed technical metric refers to the number of active contracts that are yet to be settled. Open interest decreases as soon as traders close out their positions.

The above metrics are often tracked by traders to determine the direction of the market. If more traders join the market, it means that a certain market trend is probably taking a foothold.

In early August, Ethereum surpassed Bitcoin in the options market for the first time ever.

Deribit, the largest cryptocurrency options trading platform, recently launched a . noticed the “flipping” in Recent Tweet, “We love Merge!” The company tweeted.

Ethereum’s upcoming transition to the proof-of-stake consensus algorithm has been touted as the key bullish catalyst for the second-largest cryptocurrency as well as the broader cryptocurrency market. The Ethereum spot market saw growing activity in recent weeks, with the price of the Bitcoin competitor soaring above the $1,900 level.

With Ethereum in the limelight once again, it is natural that options traders would want to get a piece of the action.

The merge, which is arguably the most anticipated crypto-related event of 2022, is expected to happen on Sept. 15. The upgrade could end up being slightly delayed due to possible technical issues that could arise during the final stretch of testing.