One of worst months for crypto is here, but you should not enter panic mode

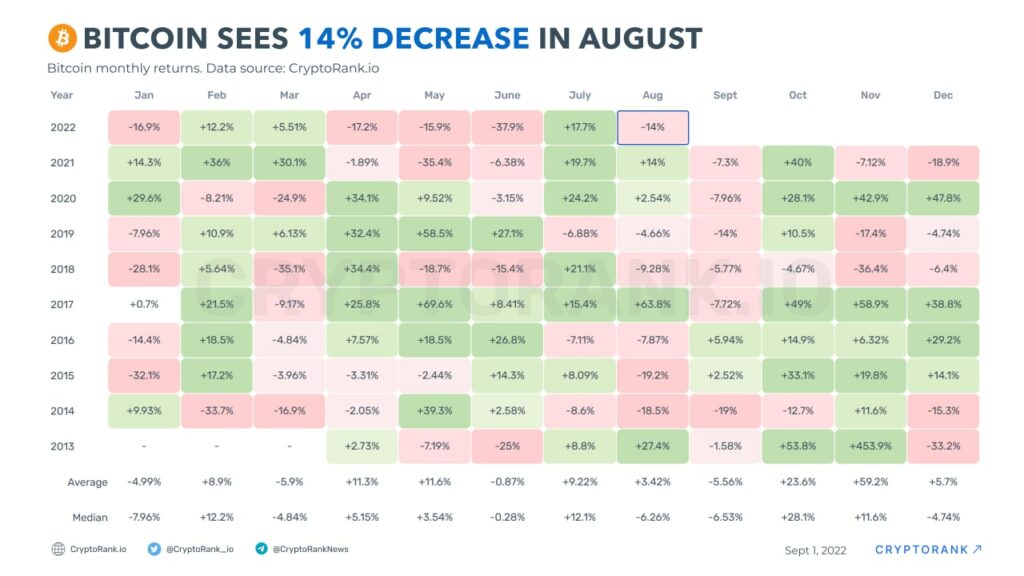

September is probably the least favorite month in the cryptocurrency market, as it has historically brought nothing but losses for crypto holders. According to data provided by CryptoRank, for the past five years, bitcoin has suffered significantly in the first month of autumn.

Bitcoin has seen only one positive September in its trading history on the market in 2016 and 2015. The average trading result for the first cryptocurrency in September is at -5.56%. Considering the average volatility of BTC, it can be considered insignificant.

The major September losses were monitored before or during the bull run, as the biggest track loss was 19% in 2014. The second biggest loss of September for the orange coin was seen in 2019 when it was trading around $9,000.

Based on the situation on the market today, we will most likely see the same movement of Bitcoin on the market as we have seen for the last few years. The stalemate on the market is a perfect time to accumulate assets like Ethereum and Bitcoin.

Eventually, the long-term consolidation could face a downside, causing slight losses for bitcoin holders and a repeat of last year’s results. Fortunately, the month after September brings a more pleasant picture to the table, with significant gains in six of bitcoin’s nine-year trading history.

What can go wrong?

The only notable event that is going to happen in September is the long-awaited Ethereum Merge update, which can become an unexpected source of volatility on the market if the second biggest asset faces technical issues that would postpone the upgrade.

Fortunately, the potential problems will have the biggest impact on Ethereum rather than Bitcoin.