Bitcoin (BTC) is a hot news sensation, and it seems that things have gone awry once again. According to Glassnode’s report, Bitcoin experienced turmoil in the network activity, leading to a series of sell-offs in the last 22 days.

When BTC made its all-time high of $68,789.63 on 10 November 2021, did investors know that the $100K dream in 2022 would be in vain?

The Long-term Holders and Short-term Holders Realized Price are two significant factors in preparing the on-chain analysis. The market becomes highly oversold when the short-term realized price exceeds the long-term realized price.

bears running

During the first half of 2022, the price of BTC fell by more than 60%. As a result, crypto king Bitcoin closed H1 at the $18,000 price level.

In July, however, BTC gave relief to its holders as the coin kept itself above the realised price for 23 consecutive days. Furthermore, BTC’s price had surged by over 15% within the 31-day period, according to data from CoinMarketCap.

This is an essential factor in the price of bitcoin that indicates short-term profitability if BTC falls below the real price of short- and long-term holders. Two possibilities can be seen from here.

First, we can see a pump in BTC trading volume if institutional investors start adding BTC to their portfolio in the bearish phase or a sudden increase in selling of both short-term and long-term investors to exit at this price, taking a slight loss.

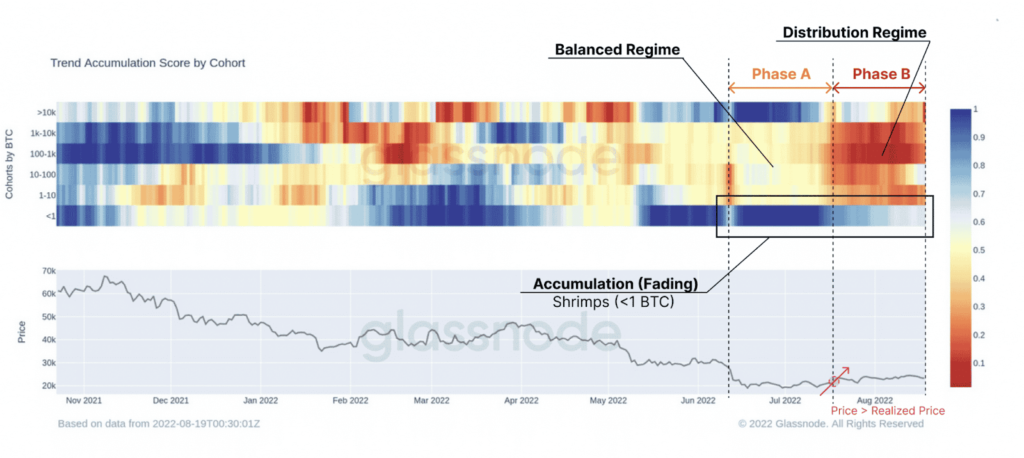

Glassnode found that investors with less than one BTC and whales with more than 10,000 BTC (excluding exchanges and miners) deposited and distributed BTC after falling below $20,000.

In case you want to ape in and buy the dip, Glassnode stated that there exists a general lack of speculative interest in BTC. Thus, it results in a decline in the exchange flows of Bitcoin.