The term ‘Whale’ refers to a trader in financial markets with a significant amount of capital. Due to the large size of a whale trader’s position, these investors are in a position to influence markets to move in either direction when they make large buy or sell orders.

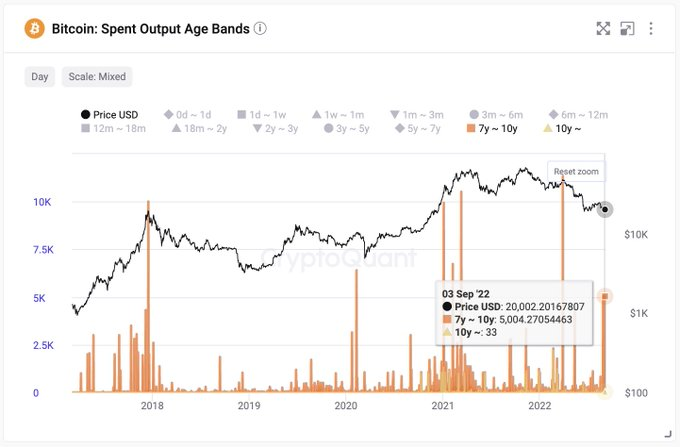

Over the past 10 days, the bitcoin network has seen suspicious activity by bitcoin whales, as they were taken Around 15,000 BTC. The most important difference between regular coins and the amount transferred is the date they were last spent. Most of these coins belonged to investors who bought BTC back in 2014.

Are The Whales Responsible For The Price Drop?

Technically speaking, a one-time injection of 15,000 BTC on the market could have caused a major plunge in the first cryptocurrency and issues with liquidity. However, despite the significance of the net amount, it could not possibly be the sole reason for the recent plunges in the asset.

CoinGlass has reported that over $350 million has been liquidated in the cryptocurrency market in the past 24 hours. While this amount may seem huge and significant, the liquidations may not have seen such a huge increase due to the gradual selling of 15,000 BTC in the market.

As reported recently, whales moved most of their older funds to the Kraken exchange and probably tried to sell them ahead of the large price drop. However, most experts believe that the main reason behind the correction is linked to the upcoming interest rate hike and the continuous strengthening of the monetary policy.

Will BTC survive the crisis?

Bitcoin is consolidating at the July level and has yet to drop below it. It is clear that the current price level is still matching a strong psychological and historical support level, which could help prevent the cryptocurrency from sinking.

The majority of sentiment indicators returned to extreme fear. Bitcoin’s Relative Strength Index shows that the asset is already oversold. But, it can still drop even lower if new macroeconomic factors weigh heavily on the crypto market.

To date, Bitcoin (BTC) is trading at 18,796, down around 6% at the time of writing

How Can One Track Whale Activities?

The impact of the whales can be felt the most in the Altcoin market. In crypto assets with market capitalizations of less than $100 million, the market will move substantially if a ‘HODLer’ decides to sell a part of their portfolio, or if a large buyer comes on board.

Before investing in smaller Altcoins it is important to be aware of their wealth distribution. Also, you should keep a close eye on the order book to see if there are any whales.

In order to identify whales, the first thing you can do is monitor the wallet addresses of the largest holders as well as exchange wallets to stay alert of any significant shifts in cryptocurrency.