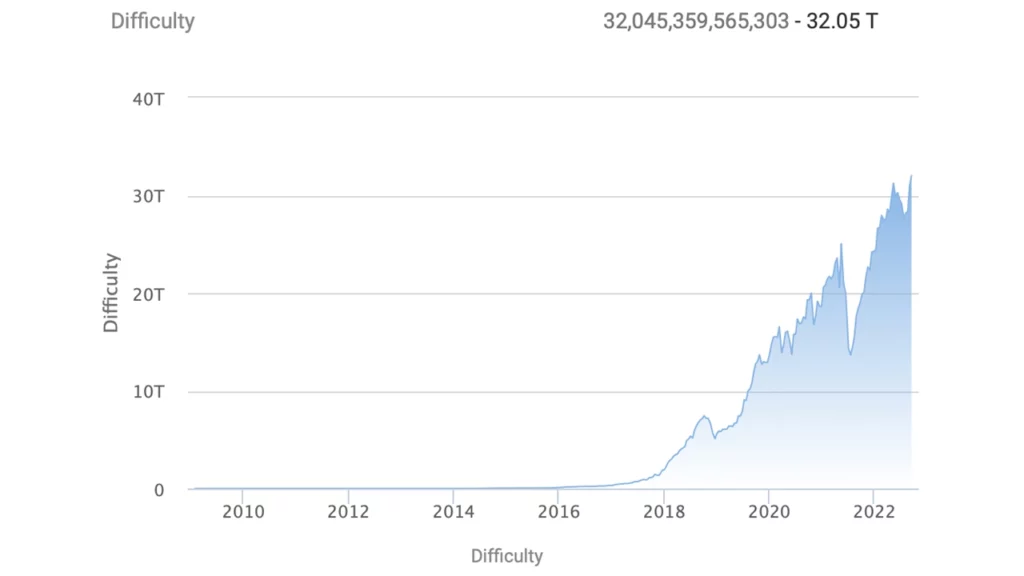

Bitcoin’s mining difficulty reached a new all-time high at block height 753,984 from 30.97 trillion hashes to 32.05 trillion hashes. After two difficulty increases during the past month, the network’s mining difficulty jumped another 3.45% higher on September 13.

Bitcoin Difficulty Reaches 32 Trillion

The leading cryptocurrency by market capitalization, Bitcoin (BTC) is now a lot more difficult for me. In fact, on Tuesday, September 13, 2022, network difficulty tapped to an all-time high at 32.05 trillion. Roughly two weeks, or 2016 block ago, difficulty printed the second biggest increase in 2022 as it increased by 9.26%.

Two weeks or 2,016 blocks before the last change, the difficulty jumped slightly by 0.63%. Following the increase today, at block height 753,984, it has never been more difficult to find a bitcoin (BTC) block reward. Furthermore, BTC’s U.S. dollar value dropped over 9% on Tuesday afternoon (ET), following the recently published U.S. CPI report.

BTC’s hash rate remains above the 200 exhash per second (EH/s) threshold and, at the time of writing, is trading at 227.07 EH/s, despite the price drop and the recent rise in difficulty. During the last 24 hours, Foundry USA has been the network’s top pool with 26.85% of the global hashrate.

Foundry is followed by F2pool with 15.4% of BTC’s hashpower, and Binance Pool with 14.77% of the global hashrate. Binance Pool is followed by Antpool (13.42%) and Viabtc (10.74%) respectively. 149 blocks were mined in the last 24 hours, and Foundry USA discovered 40 of those blocks, while F2pool captured 23 blocks.

Currently, the BTC block time is 9:17 minutes per block, and I have 2,011 blocks left until the next difficulty change expected on September 27, 2022. At the current block lag speed and the hash rate realized today, the network could see a negative 3.7% decrease.