Bitcoin and other cryptocurrencies surged early on Tuesday before falling sharply

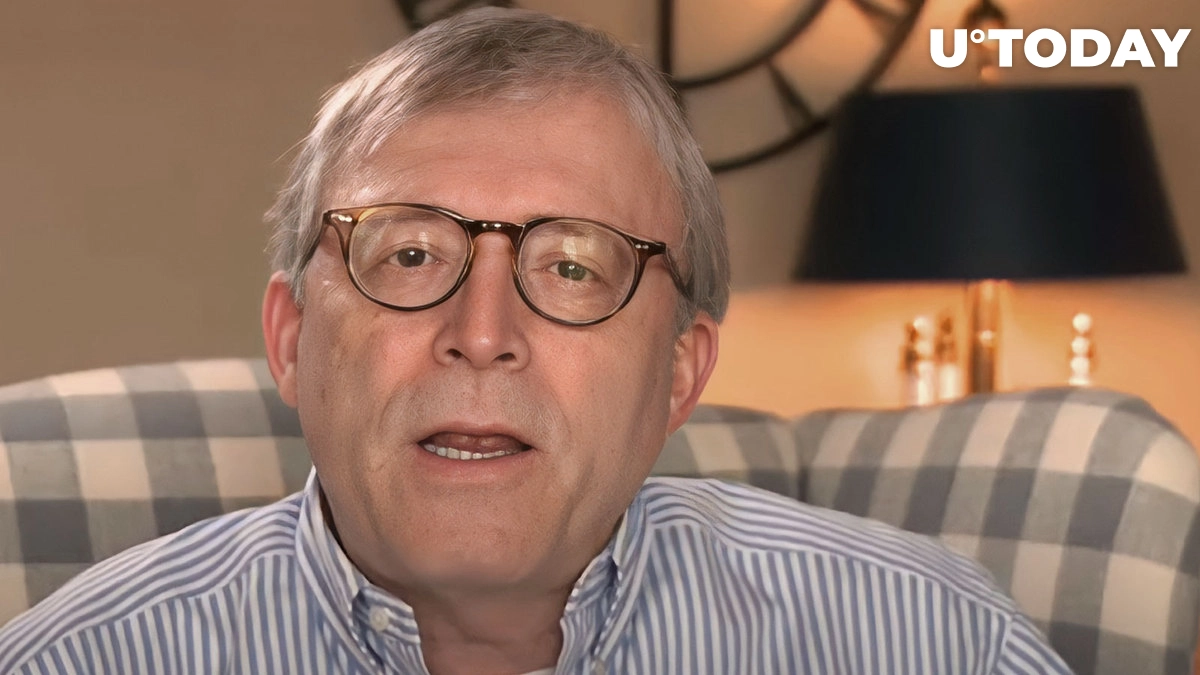

veteran businessman Peter Brandt believes that “the market excels at creating surprises and serving the humble pie to overconfident traders.” He said this in response to a tweet that the “unexpected” was always happening in the market, which mentioned the tweet, “Bitcoin was going to the moon when everything collapsed.”

In topsy-turvy trade, Bitcoin and other cryptocurrencies surged early on Tuesday before falling sharply. The largest digital coin by market value rose by more than 7% at one point on Tuesday to reach $20,385. However, the gains were temporal, and the declines extended until Wednesday.

At the time of publication, bitcoin, the largest cryptocurrency by market cap, was trading down 6% at $19,066.

In the early months of the year, Brandt issued a warning, stating that historical price corrections for Bitcoin took many months and that it might take some time for the price of BTC to reach another all-time high.

Brandt emphasized this by displaying a chart with important bitcoin price highs and the time required to cross them. He specifically noted that it took BTC 21 months in 2013, 40 months in 2017 and 36 months in 2020 to reach new peaks later.

On Nov. 10, Bitcoin’s price reached an all-time high of $68,789; however, it has since dropped by more than 72.35%.

down in the process?

According to on-chain analytics firm, Santiment, “Trading volumes have heated up for the crypto markets, and bitcoin in particular. During the big phase on Tuesday, BTC peaked at its highest level of trading since June 14th. . Volumes have gradually increased throughout the year since coming down at the end of January.”

Analysts believe that trading volumes reach their highest when markets capitulate, and such capitulation creates major bottoms. Volumes also hit their peak in June.

However, popular firm Arcane Research says that it is important to pay close attention to macro events: “BTC’s intraday volatility hit record highs during last week’s FOMC meeting. This shows why it is worth paying attention to important macro events. And you should already mark the US CPI’s September release on October 13th and the FOMC’s next press conference on November 2nd in your calendars.”