The Bitcoin price continues its struggle at around $19,000, displaying a monotonous trend for more than a month. While pre-determined upswings did raise the price beyond $20,200, it failed to surpass the pivotal resistance at $20,800. Therefore, the repetitive failed attempts now may have driven the market participants away, and hence it may not be a good sign for the BTC price ahead.

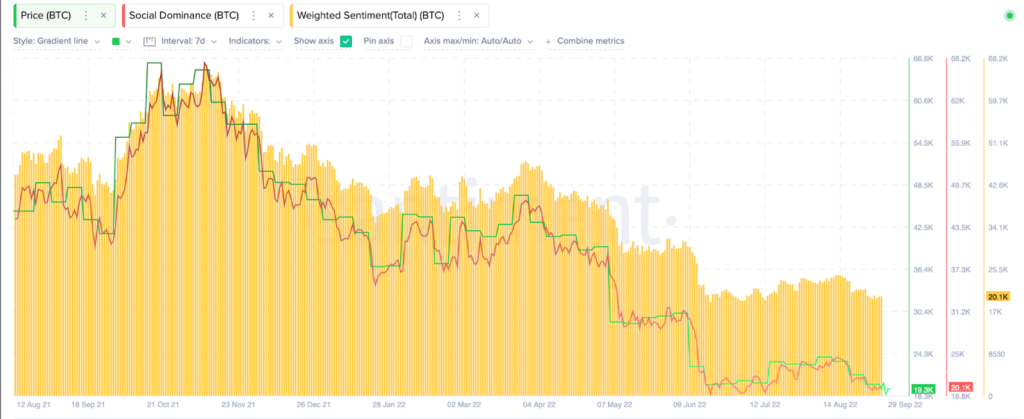

Market sentiment for any asset determines the upcoming move, regardless of the current price trend. While the BTC price is hovering around the same level without any strong attempt to reverse the trend, investors look for other options. Hence, the market sentiment towards Bitcoin remains negative, according to Sentiment data.

Social data shows a weighed sentiment score of -0.33, while the BTC social media mentions tanked below 20%. This indicates that interest in the asset has dropped at the moment. Moreover, the percentage of addresses holding more than 1000 BTC has remained steady at around 2117 addresses over the past 3 days, following a sharp decline of 26% since the beginning of September.

apart from this, bitcoin miners The reserves also reached 1.86 million BTC, which it has held for almost a month now. This passivity among miners is mainly due to the huge sell-off in prices in August.

Collectively, Bitcoin broke all bull market models at the top earlier and is also on track to break all bear market models at the bottom. However, if the traditional markets get worse with rising inflation or an intensifying recession, BTC charts may even worsen. Until then, a consolidated narrow trend may prevail for Bitcoin.