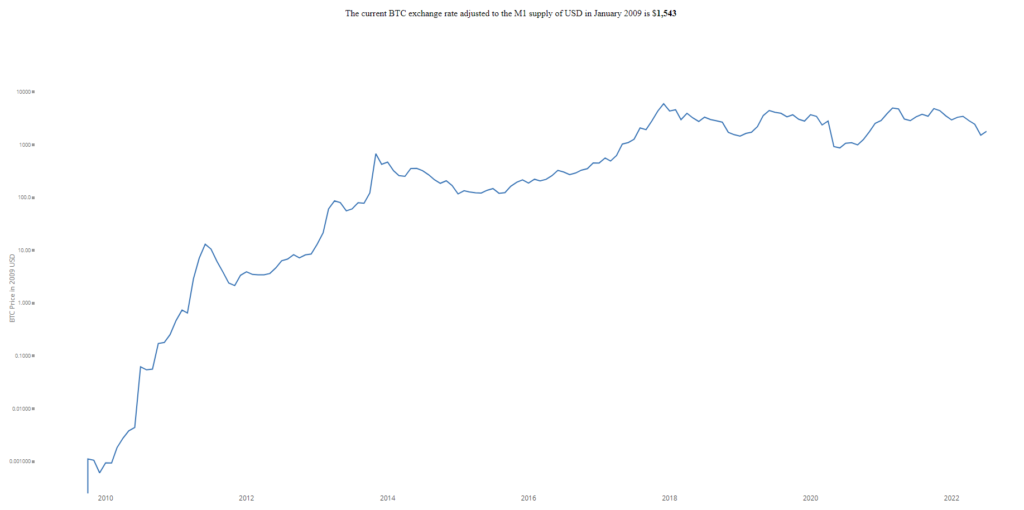

Change in U.S. monetary supply makes Bitcoin’s real value far below $20,000

The USD is the main currency used to determine the value of bitcoin and most digital assets in the industry. However, the supply of the world’s leading currency has changed drastically over the past two years, M1 monetary data shows.

How does it affect real value of Bitcoin?

The monetary supply of the United States directly affects the purchasing power of USD, hence, it changes how various assets and commodities are valued against it. Bitcoin is no different.

Back in 2017, a rally in the cryptocurrency market dragged BTC and other cryptocurrencies to their absolute tops. The price of the first cryptocurrency reached $19,000 and then returned to an absolute low of $3,000.

After the bullrun that concluded in November 2021, Bitcoin plunged below the 2017 top, which raised a lot of concerns among investors who thought the drop below it was impossible. However, the real value of Bitcoin was far below it even before reaching the same price we saw in December 2017.

Adjusting the price of bitcoin to the M1 supply

Thankfully, it is easy to determine the true value of BTC, adjusted largely to the USD supply. According to the adjusted chart, the BTC exchange rate today is lower than its 2017 price.

The “true” Bitcoin value today is at approximately $1,500, while being at $6,000 back in the ICO era. The rise in monetary supply was so disruptive that even the ATH value did not put Bitcoin above the 2017 high.

Unfortunately, the financial regulators of the United States have not yet been able to control the growth of inflation due to the rapid increase in the monetary supply over the past two years.