Bitcoin has been facing enormous liquidity conditions in recent times. Moreover, the global liquidity crisis has also impacted the crypto space, specifically Bitcoin. Therefore, a significant bearish trend has been speculated for the star crypto that may drag the price lower.

The market largely depends on liquidity and hence Sam Rule, a renowned crypto market analyst, focuses on global liquidity and its impact on the BTC price. As a result of the current liquidity crisis, central banks counter this by keeping interest rates low and purchasing sovereign bonds and other financial instruments.

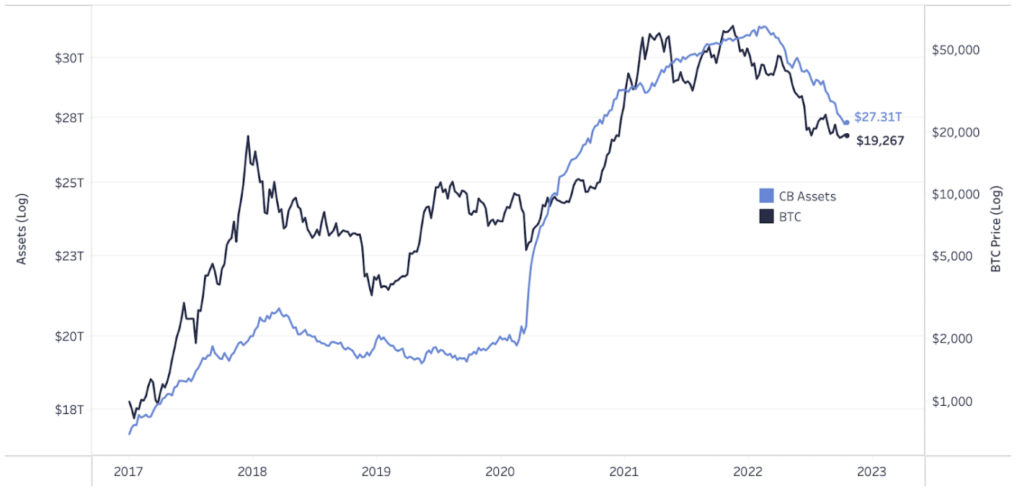

Rule further states that the bank balance sheets of various central banks like of US, China, Japan, etc have peaked in 2022, which are 20 times higher than that of 2003. And interestingly, Bitcoin’s new All-time high in March 2021, had collided with the peak of the annual accumulation of these banks.

Since then banks have stopped injecting liquidity into the markets and have revised their policies to fight rising inflation. Conversely, banks have consistently drawn liquidity from the market, hence creating a liquidity crunch which has had a massive impact on the stock as well as crypto markets.

On the other hand, the Bitcoin miner reserve & the BTC price has witnessed a significant drop as the active sales by the miners have declined over a month. As the miner reserves are on a constant rise, Bitcoin is expected to undergo a short-term bounce very soon.

However, as the $19,100 support has been tested several times, it could easily break above with an extended bearish action. BTC price could decline below the yearly highs once it breaks these support levels.