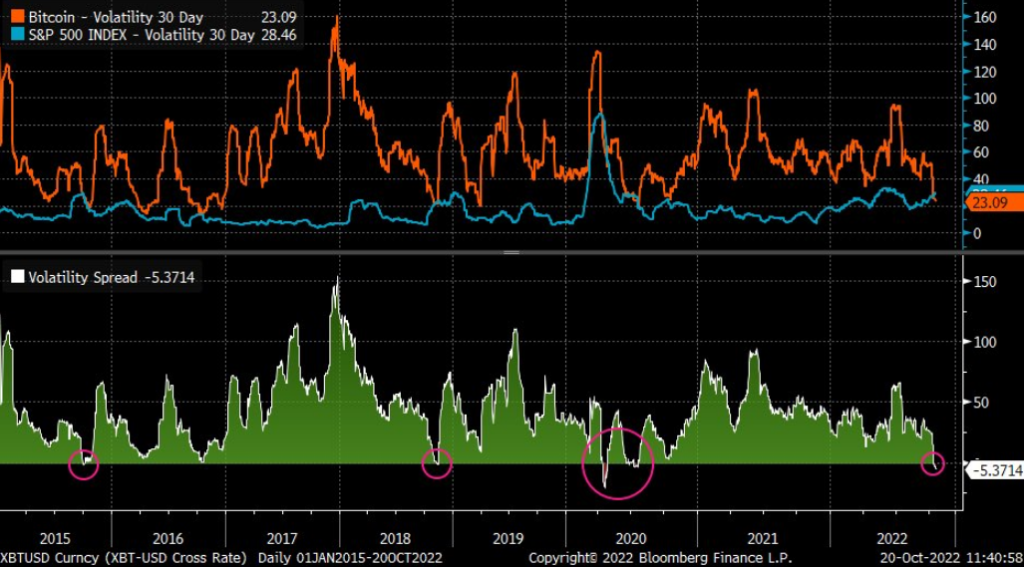

Volatility used to be one of the most defining characteristics of the largest cryptocurrency, but it is not the case anymore

According to information Provided by Bloomberg, bitcoin is now less volatile than the benchmark S&P 500 index for the first time since mid-2020.

The world’s largest cryptocurrency has been struck in a rather tight range over the past few months, with both bulls and bears now playing tug-of-war.

Historically, the crypto king has been described as a risky and volatile asset. Its volatility was due to the relatively small size of bitcoin’s market capitalization. The largest cryptocurrency is currently valued at $367 billion. Meanwhile, the S&P 500 Index has a market cap of $35.1 trillion.

Earlier this week, the S&P 500 index saw a significant rally because of a strong earnings season. However, Bitcoin failed to catch up with U.S. equities despite trading in tandem with them for virtually the entirety of the year.

While it is now unusual for bitcoin to be “boring” during bear market cycles due to low prices and volatility, trading volumes remain consistently high.

It is not far-fetched to assume that such a long period of volatility could be followed by a major flush in leverage. Hence, the substantial drop-off in volatility is unlikely to lead to long-term stability.

Bitcoin suffered a sharp decline with stocks earlier this year after the US Federal Reserve began raising interest rates sharply. Bitcoin is likely to experience more volatility as interest rates are expected to continue rising.