Following mild recovery of DeFi, Aave gaining some traction on market

Following the market correction, Aave successfully rebounded above the local resistance level of the 50-day EMA despite problematic performance from its rivals such as Cardano and XRP.

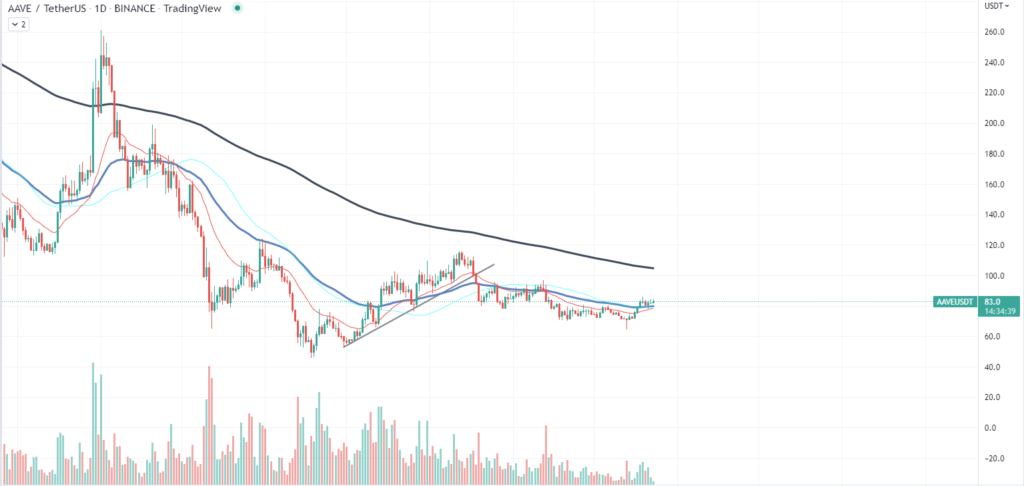

According to the daily chart of the token, Aave has successfully moved through the 50-day moving average and gained a foothold above it after a few days of consolidation. The breakout on Oct. 18 was the fourth attempt of the token to break the downtrend. Unfortunately, it is too early to say that Aave made it through the downtrend.

Volume speaks for AAVE

According to the volume profile, the bears were slowly losing power and could no longer push Eve down. Decreasing volume during a downtrend is one of the most important signals for a reversal. Following the breakout, we are seeing a reversal in the volume profile, indicating that AAVE may enter a reversal despite problematic market conditions.

It is important to note that the reversal on volume profiles for Aave is nowhere near explosive, which shows that the change in the behavior of investors is purely technical and no major factors that would push Aave to new highs in almost no time appeared on the market.

Next Step

The next threshold Aave should conquer is the 200-day moving average. Breaking that point, the coin will move up to the MA crossing, generating a strong reversal signal and potentially attracting fresh funds into Ava.

In the last few weeks, we saw a mild recovery from the DeFi industry, which could be one of the main factors behind Aave’s recovery on the market. However, it is hard to tell if decentralized finances are coming back, which is why betting on a full trend reversal on assets like Aave remains risky.